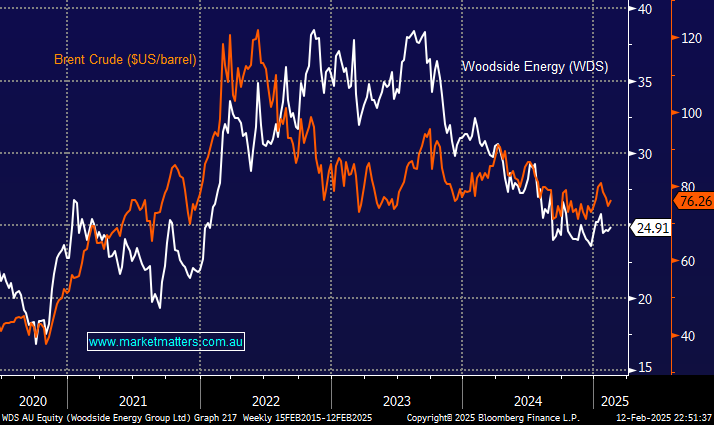

We regularly get asked if it is time to buy WDS, and for the last few years, the general answer has been, “Be patient, grasshopper”. The stock rallied +1.7% yesterday in line with a bounce in oil, but herein lies the issue: Trump is fixated on getting the oil price down, which makes sense if he implements some inflationary policies. We’ve already heard him sing “Drill Baby Drill”, but he’s been busy elsewhere in the short time he’s been in power:

- In late January, he declared a national energy emergency to boost U.S. oil and gas production and reduce the US’s reliance on foreign oil imports.

- Trump has intensified economic pressure on Iran, aiming to reduce its oil exports to zero.

- In a speech at the World Economic Forum, Trump suggested that lowering oil prices could resolve the Russia-Ukraine conflict.

- Trump’s tariffs on Canadian oil are expected to raise U.S. gasoline prices if enacted next month.

On balance, what he said and done is net bullish oil so far, but we believe he wants prices lower; the rest is noise. Overnight oil fell well over 2%, dragging US oil stocks with it, after Putin and Trump agreed to talks on Ukraine.

- We aren’t interested in picking the low for oil prices, and by definition, WDS, when President Trump is keen to drive them lower.