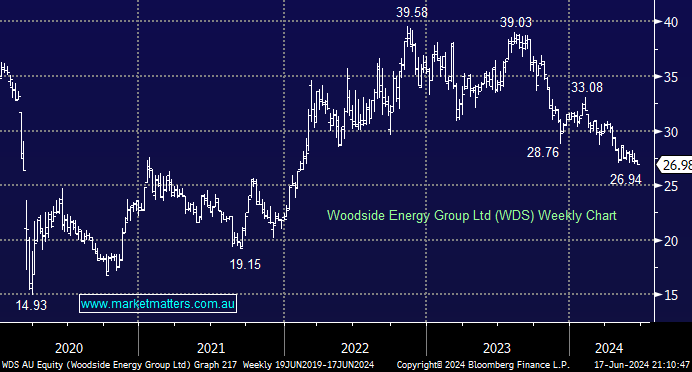

WDS fell another 2.3% on Monday, extending its drop year-to-date to 13.1%. As we’ve discussed recently, MM believes oil is “looking for a low.” After stalking WDS through 2024, we believe value is starting to present itself, although we are conscious that international giants such as Exxon (XOM US) and Chevron Coro (CVX US) look to be in the early stages of their respective pullbacks. Last week, Macquarie upgraded WDS to outperform with a $32 price target, believing the stock was cheap compared to its US peers and the market is excessively pricing in commodity and climate risks.

- We have placed WDS back on our Hitlist for the Active Growth Portfolio as it trades under $27.