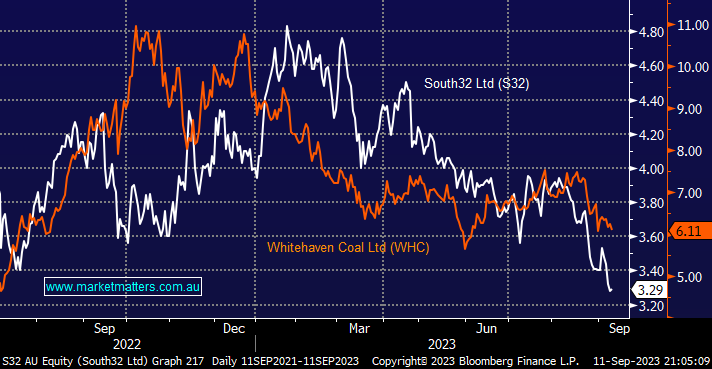

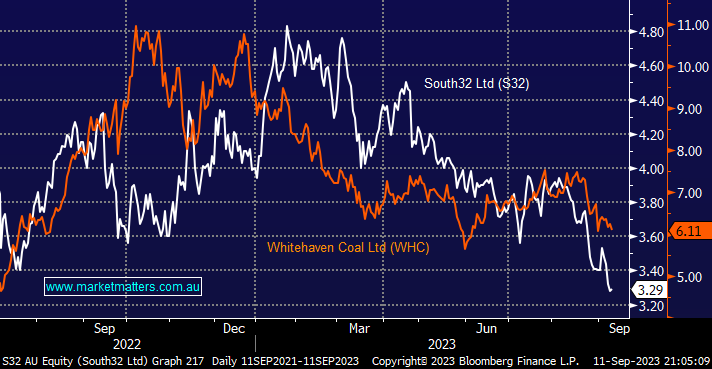

Over recent weeks MM has been contemplating switching out of SFR into S32 on valuation grounds but we’ve held fire with over 20% of S32’s revenue coming from coal which is illustrated by its strong correlation with Whitehaven Coal (WHC). The very unpopular fossil fuel combined with aluminium/alumina makes up over 50% of S32’s revenue which is not overly exciting at present, especially when compared to the medium-term outlook for copper.

- We prefer WHC over S32 for coal exposure but their correlation is high.

- S32 is not looking like a logical alternative to SFR even as we become increasingly bullish toward China.