Hi Sandy,

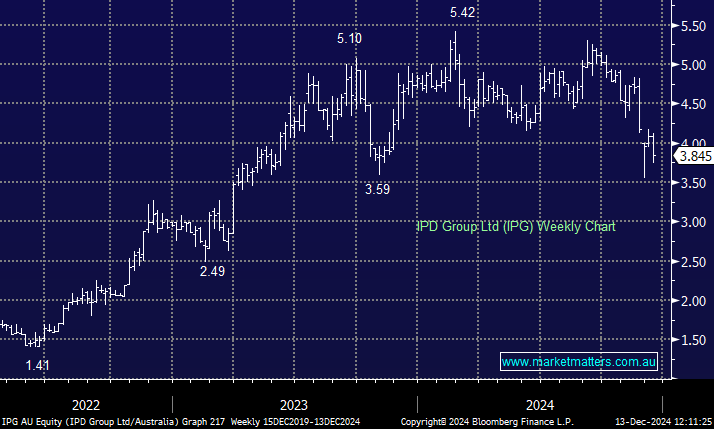

IPG provided 1H25 earnings guidance at the end of November which was circa 12% below expectations in part due to the timing of larger projects. That saw universal downgrades to FY25, FY26 & FY27 earnings estimates from analysts. Whilst it was a disappointing trading update, IPG’s order backlog remains strong as the company remains exposed to the high growth electrification and data centre sectors. We like the company, but like many in the space, expectations were too high.

That has been a common theme in the ESG exposed stocks over recent years, with Lithium companies’ indicative of that trend. We covered our views on Friday morning on Lithium stocks, ultimately concluding that the risk/reward looks good at current levels for both PLS and IGO with the Lithium price stabilising.

Our thesis on coal stocks, and it has been tested of late, has always been around the complexity and time associated with the global energy transition. We think it will take longer than many expect, and coal companies can produce strong earnings while that happens. We remain bullish on coal stocks generally.