Coal stocks and related companies

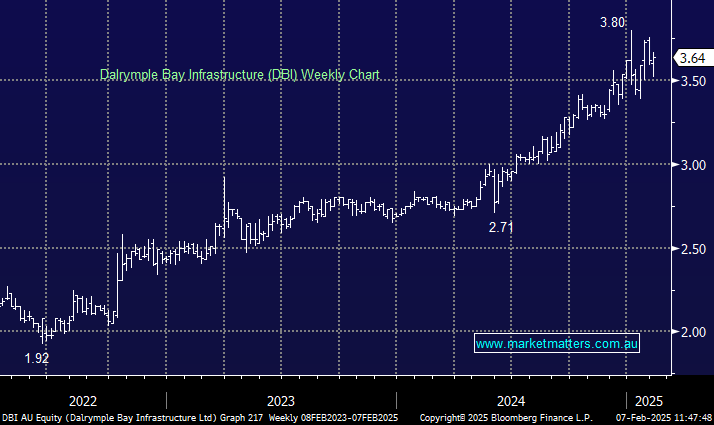

Esteemed team, The price of coal stocks is rather low now. It could be an opportunity to win or to lose depending on how the year unfolds. You believe NHC is a good dividend stock and WHC is a good growth stock. I have noticed that WHC is projecting much higher dividends after 2025 and therefore may become both a high growth and a high dividend stock. Such stocks are my favourite. I like WHC better because they are into coking coal which I think has a longer and brighter future than thermal coal. What are your thoughts on my comments? DBI has had a pretty good run as a coal infrastructure stock. Do you think it will go higher. or has it run it's course? I look forward to your always wise and well balanced remarks. Paul