This morning, we quickly updated our stance/position on some of Shawn’s Trading Ideas. We now have four open positions, more than we envisaged when we started the new addition to the MM service following demand in our most recent subscriber survey.

Bendigo & Adelaide Bank (BEN) $13.38

We highlighted a trade in BEN at $12.48, targeting a quick move towards $13; this has already been exceeded. The mooted $350 million annual levy to keep bank branches open in the bush gave BEN a nice “shot in the arm.” However, with negotiations now underway between Jim Chalmers and the banks, it’s time to scratch the position, i.e., the reason for the trade is now in the rear view mirror.

- We are planning to scratch BEN with the position up ~8% this morning – this was always going to be a short and sharp play.

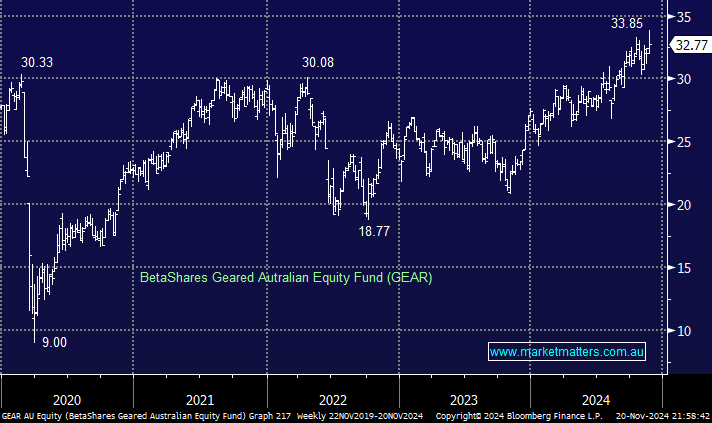

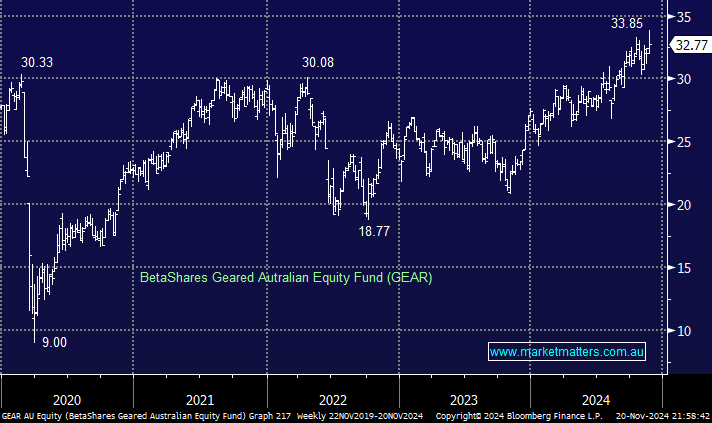

BetaShares Geared Australian Equity Fund (GEAR) $32.77

We added the GEAR ETF at $32.18 on Monday before the ASX200 reversed strongly higher, but unfortunately, the market’s sharp 120-point reversal over the last 48 hours has left us uncertain, and we believe caution is now the better form of valour.

- We plan to scratch for a +2% gain on this position this morning, ~$32.70, after the market’s lacklustre breakout on the upside.

Whitehaven Coal Ltd (WHC) $6.73

We added WHC in late October to the trading ideas section, and the position has only put us to sleep so far! If we had no position today, we’d be inclined to wait and see; hence, we’re tightening our stop as a compromise.

- After four weeks of treading water, we are raising our stop slightly to $6.54, which will either get hit or we’ll continue to hold.