Hi Debbie,

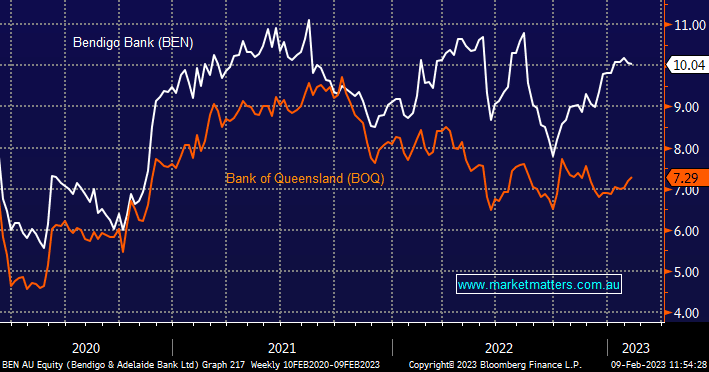

The regional banks can be tricky place to invest commonly delivering both amplified under and outperformance. As you say BEN has outperformed because as a business its performed far stronger but we now believe that’s built into the respective share prices.

In December BEN delivered a strong trading update showing cash earnings of $245mn for the 5 months to November 30th, around 15% ahead of consensus estimates, the share price rallied strongly on the beat with NIM (net interest margin) surprising on the upside i.e. BEN’s level of rate sensitivity being greater than the market expected. Conversely BOQ unsettled the market when directors announced they had lost confidence in the CEO after 3 years, another big job for the head-hunters.

- at current prices of Bank of Queensland (BOQ) $7.27 and Bendigo (BEN) $10.05 we like BOQ believing they can play some performance catch.

- BOQ is forecast to yield strongly over the coming 12 months i.e. 6.6%