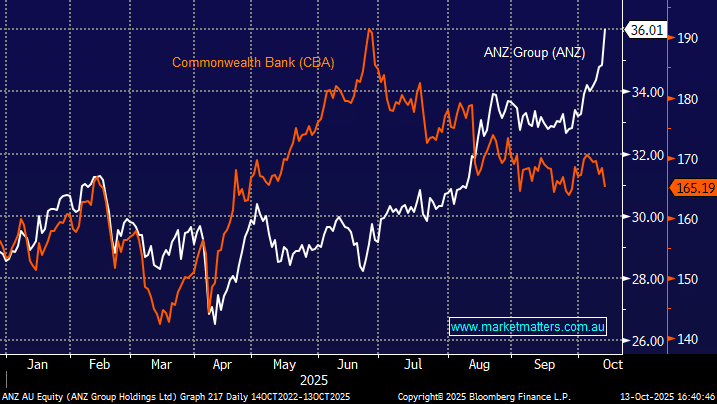

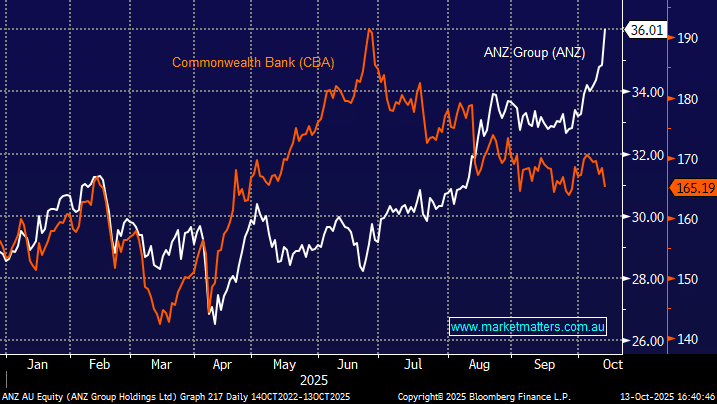

CBA was driven higher by momentum traders into the EOFY, pushing it up to ~$190/sh, but ever since, it has peeled away, closing ~14% below this year’s high on Monday. While CBA is by no means ‘cheap’, it’s cheaper than it was a few months ago, and clearly some of the momentum money has exited. We still prefer ANZ, even after recent outperformance, believing it has greater ‘self-help’ upside relative to CBA, and the 10 PE point premium held by CBA could further erode. That’s not to say that CBA should not trade at a premium, it has a better technology stack positioned more favourably for the world of AI, however the current premium still feels excessive.

- We see some value re-emerging in CBA around $165, though we believe ANZ’s update yesterday was solid, and should help to regain some of the markets lost confidence over the years, as long as they execute.