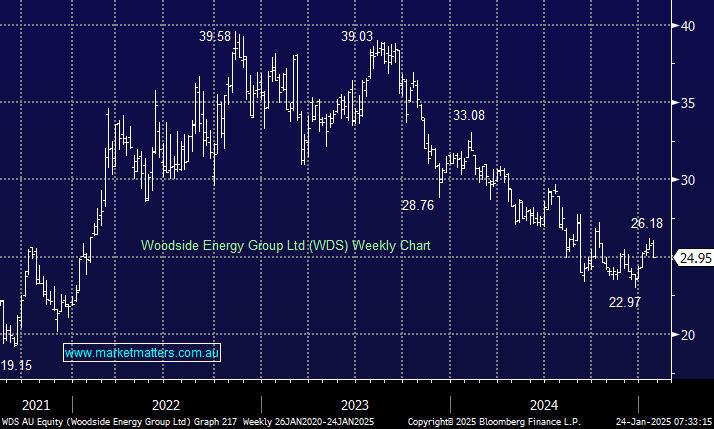

WDS has primarily followed the lower oil prices in recent years, and due to this strong correlation, we need to be bullish on oil before pressing the accumulate/buy button on WDS. Operationally, there were no significant surprises from WDS in 2024; the metrics are solid, but as oil and gas prices struggle, it’s tough for the producer to gain traction. Importantly, for yield-conscious investors, WDS is forecast to pay a 60c fully franked dividend in February; however, with large CAPEX bills on the horizon, the yield will likely fall from currently lofty levels above 7% toward 4.5% by 2026.

- We continue to believe WDS is looking for a low, but it’s not compelling without a positive catalyst from oil.