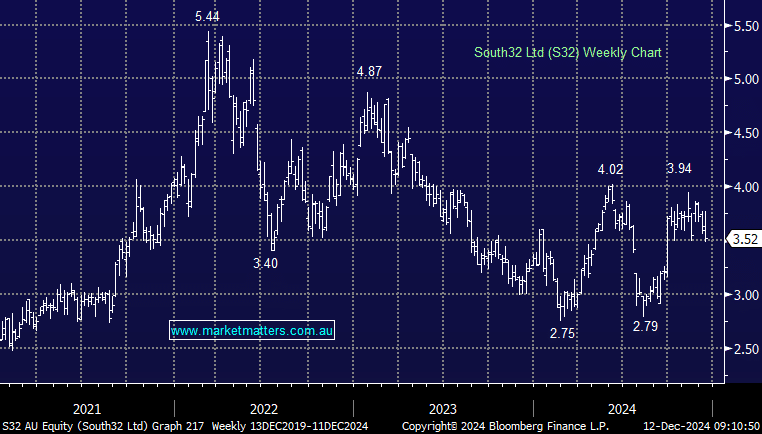

We are selling South32 (S32) given the potential for production issues stemming from their Mozambique operations. Take profit, re-allocate funds elsewhere.

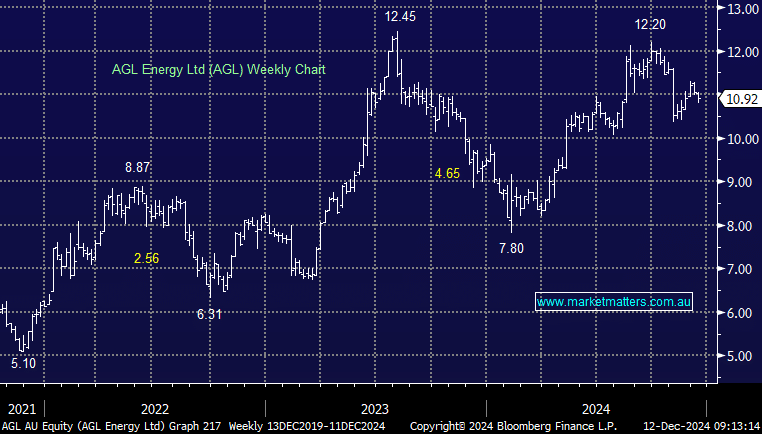

We are taking profit on AGL Energy (AGL) in the Growth Portfolio only (retaining AGL in the Income Portfolio). The growth outlook has reduced mildly in recent months and we see better opportunities for growth elsewhere.

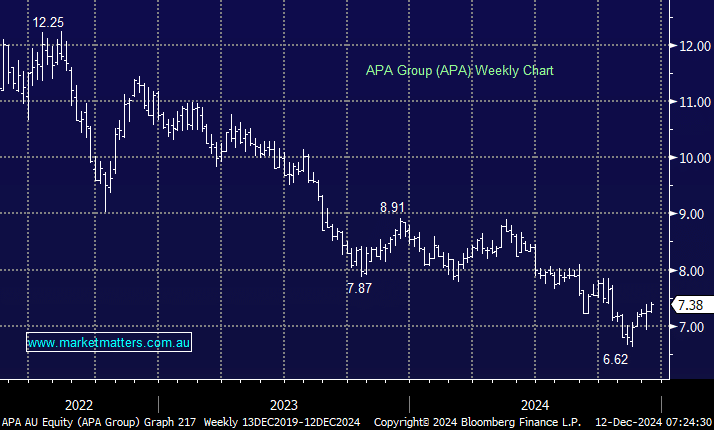

We are adding APA Group (APA) to the Growth Portfolio. While we appreciate this is not a typical growth stock, we think the combination of a depressed share price and an incrementally more attractive yield as rates fall, will lead to growth in price supported by a strong yield.

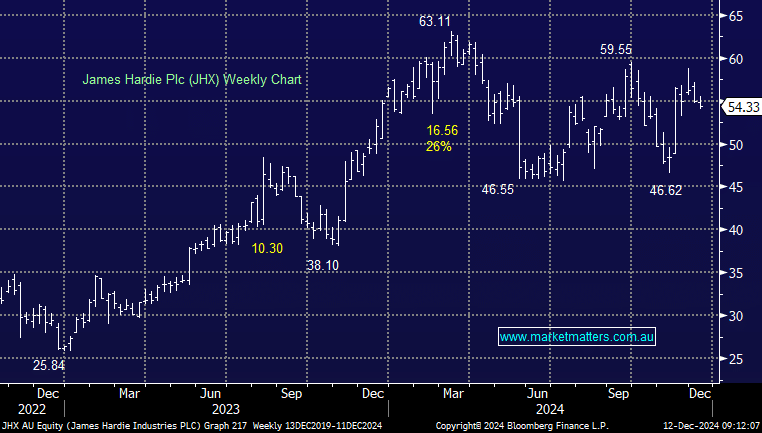

We are buying James Hardie (JHX) in the Growth Portfolio to further skew towards US exposed stocks, underpinned by supportive policy and a recovery in 2025 across construction markets.