Your views on APA please

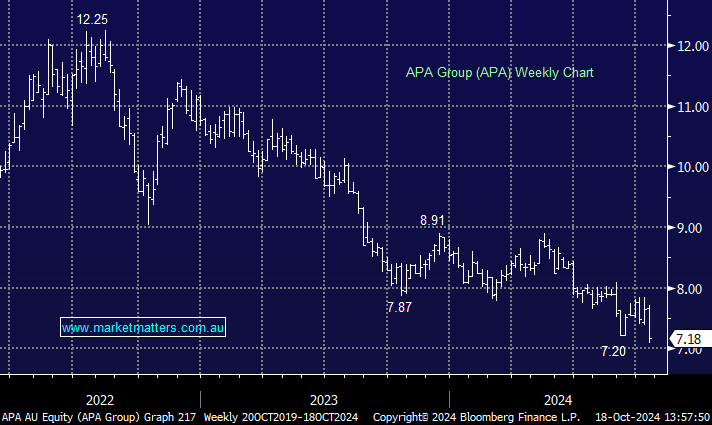

Hi James and team, Thank you for keeping us on the ground in this volatile time. What are your views on APA please, given that UniSuper has just unloaded a huge block trade and I would appreciate insights into the reasons for the sale. It seems the trend is against the stock as it has failed to bounce back when interest rate expectations are down and gets hit hard when rates trend back up. Regards, Adel

Hi MM,

MM has been positive on APA’s prospects in a number of recent updates, including, as I understand it, it’s yield and potential for capital appreciation over time from current levels.

Can you please comment on UBS’s recent downgrade of APA to Sell, with a price target of $6.60 I believe, and the various concerns raised by UBS including in relation to APA’s balance sheet, APA potentially cutting the dividend to fund growth, and UBS’s reduction of long-term forecasts. Do you disagree with UBS's concerns?

These comments are from a summary I have read of UBS’s report. I have not read the actual report, so if any of what I have written above is inaccurate, please point this out.

Thanks, Darren