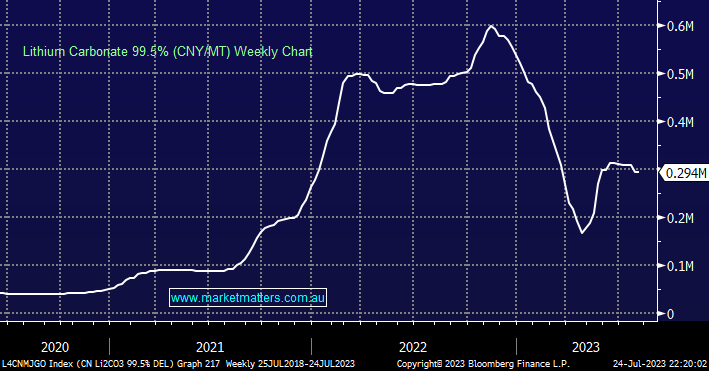

Last week saw a new Lithium Futures contract start trading in China but it was a rocky start for the essential ingredient for current-style electric-vehicle batteries. Contracts for January’24 delivery plunged below 214,150 Yuan on Friday and while paring early losses they still closed -13% lower as the market flags lower prices during that time frame. These new contracts are aiming to provide more transparent lithium pricing while enabling both producers & users to hedge their risk moving forward.

- Sentiment toward lithium has been soured by an anticipated surplus of lithium products in 2024.

- Demand for EVs is gathering momentum but markets are signalling that supply is set to more than meet requirements.

Our “Resources into 2024 webinar” (recording available here) held on 15th June discussed the complexities involved with the mining/production of lithium i.e. it’s far more like a chemical operation as opposed to traditional mining:

- We can all picture holding a lump of say inert coal or iron but do you remember from school the reaction when a piece of sodium (a related element to lithium) was dropped into some water, it literally goes crazy – probably too dangerous for students today!

Subscribers know that at MM we believe the transition to a cleaner world is going to be a far tougher journey than many believe and markets aren’t fully pricing in the risks in many cases. This week we saw S32 endure a cost/timing blowout as new mineral projects are struggling as the world moves toward decarbonisation, recently we’ve heard a similar narrative from IGO Ltd (IGO) and Lake Resources (LKE) making us reticent to value future projects as optimistically as the market – the global squeeze on materials and skilled labour is flowing into the renewable energy sector.

- We can’t get overly excited towards lithium per se while it trades in a steep backwardation i.e. future prices are lower than today.

- Just because a company is focused on renewable energy doesn’t mean it’s a quality business that’s going to see its shares roar ahead aka the .com bubble of the late 1990s.

When the ESG stocks came under pressure yesterday, the likes of Whitehaven (WHC) and New Hope (NHC) both rallied over +3% leading us to look for any correlation between the two – alas nothing was overly forthcoming on a month-to-month basis except coal has been a better investment over the last 18 months.

- We believe coal and lithium stocks should be evaluated on their own merits.

This morning we’ve briefly looked at 4 ESG related stocks, all of which struggled yesterday after Core Lithium (CXO) plunged the most in 8 months following the company flagging lower production guidance. We are very conscious that this is a crowded trade as investors focus on the increasing demands for EVs in the years ahead:`