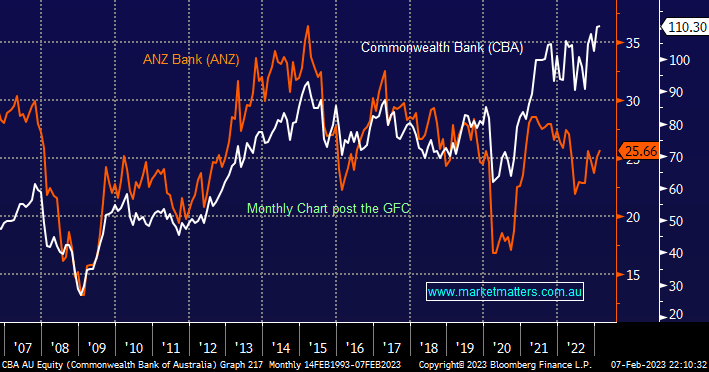

MM is currently holding 15% of our Flagship Growth Portfolio in the Banking sector equally across 3 stocks i.e. Commonwealth Bank (CBA), Macquarie Bank (MQG) and National Australian Bank (NAB). We recently trimmed MQG into strength leaving us slightly underweight towards the overall sector but nothing dramatic and with the current price action it feels correct, the main question we pose today is one regularly discussed by brokers i.e. is CBA too expensive and is time to switch, firstly we’ve taken a snapshot look at CBA and ANZ:

Commonwealth Bank $110.30

Australia’s largest bank is often described as the world’s most expensive bank but it keeps delivering having rallied to all-time highs last week plus the stock is forecast to pay a $2.10 fully franked dividend later this month. The big issue is around price with CBA trading well above its long-term average valuation as investors adopt a conservative stance towards the market and sector in today’s uncertain environment.

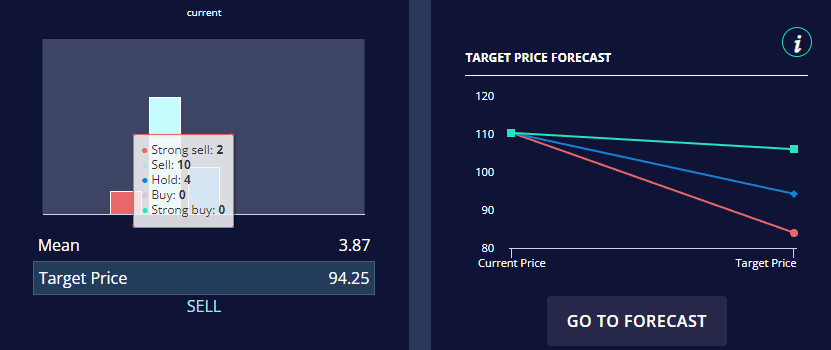

- CBA P/E for 2023 is Est to be 17.9x whereas the long-term average is 16.4x i.e. it’s trading +9% above its long-term average valuation and a big premium to the broader sector. This is not a new theme for CBA, and there are reasons why it should garner a higher multiple, however, right now the valuation gap is extreme.

Analysts clearly aren’t fans of CBA around $110 with 2 strong sells, 10 sells, 4 holds and zero buys but at this stage, it appears investors are scarred to sell CBA.

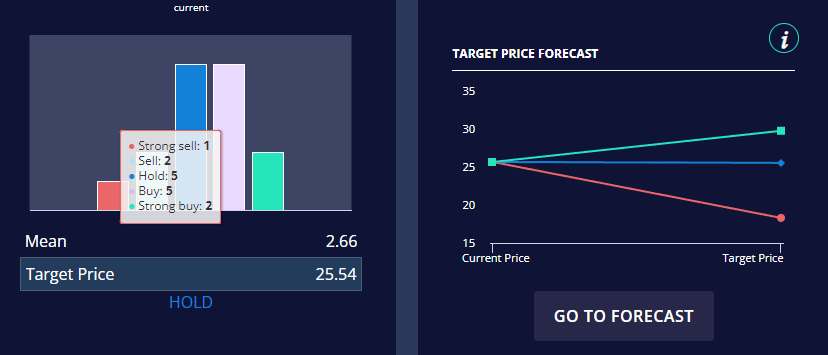

ANZ Bank (ANZ) $25.66

ANZ has slowly started to slowly outperform CBA a factor which we can understand when we consider the relative valuations plus its forecasted 5.7% fully franked over the next 12 months is attractive to yield-hungry investors.

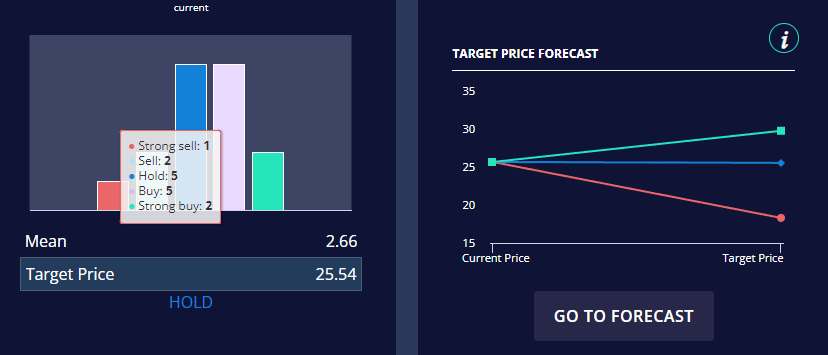

- ANZ P/E for 2023 is Est to be 10.7x whereas the long-term average is 12x i.e. it’s trading -10% below its long-term average valuation.

Encouragingly ANZ’s market share is trending higher in mortgages and business lending which raises the question of why is it trading so cheap compared to its average, and CBA. Not surprisingly the analyst’s view towards ANZ is more positive than on CBA with 7 on the buy side of the ledger compared to 3 on the sell side.

We can see no reason for this effective 19% variance towards both banks long term average valuation and with CBA trading at all-time highs and ANZ significantly below its comparative line in the sand a switch makes sense in our opinion for our Growth focussed portfolio.