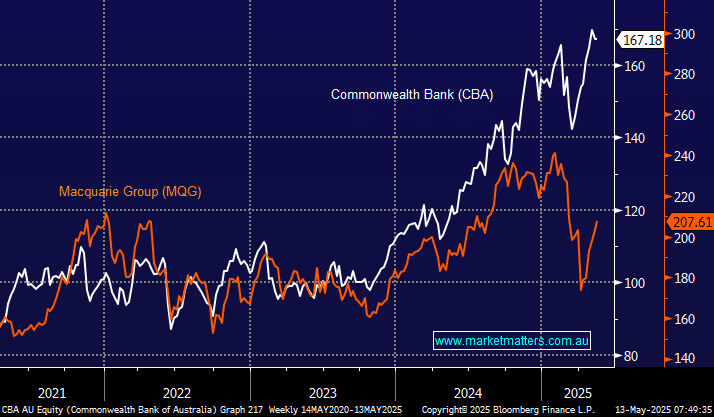

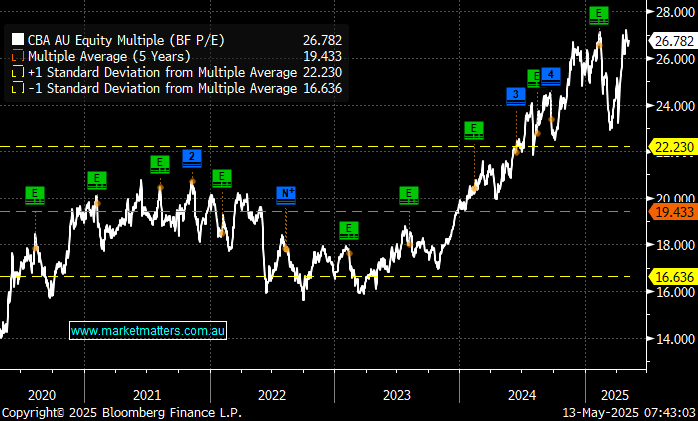

CBA has been a huge beneficiary of the “safe” money pouring into the ASX, but it doesn’t matter how great a company is; it still has a fair valuation. CBA is up almost +13% so far in 2025, plus it paid a healthy $2.25 fully franked dividend in February, but after testing its all-time high this month, the bank is trading on an excessive valuation (26x) and we believe this elastic band is very stretched.

- We can see CBA grinding to new highs, but we believe its outperformance in 2025 has peaked.

Macquarie Group (MQG) is set to benefit from the next chapter of Trump 2.0 as tariff concerns slowly fade. US tax cuts and deregulation should benefit the investment bank, whereas they will have minimal impact on CBA. MQG is also trading on the cheap side, especially compared to CBA, and we believe there are tailwinds building across many of MQG’s divisions; We think MQG is poised to outperform CBA into Christmas.

- We still like CBA for yield, but MQG is now our preference for capital gain: MM is long MQG in our Active Growth and CBA in our Active Income Portfolio.