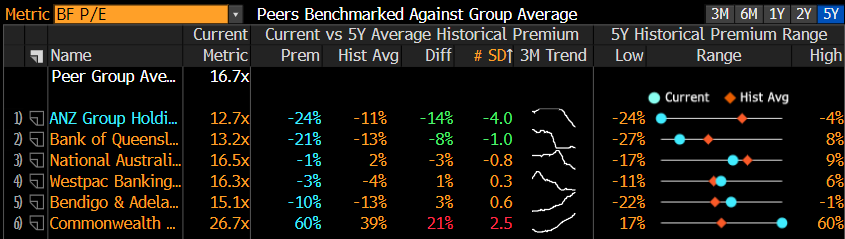

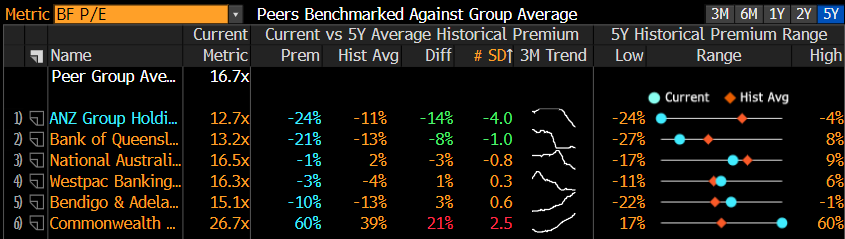

One of the most consistent messages from analysts during 2024 is that banks are expensive, and cannot justify such high valuations, yet they’ve continued to appreciate. Being long the banks in 2024 has worked a treat, and no doubt, many income investors have cheered the returns. However, the story has not been a linear one across the sector and the obvious question to ask ourselves is, what comes next?

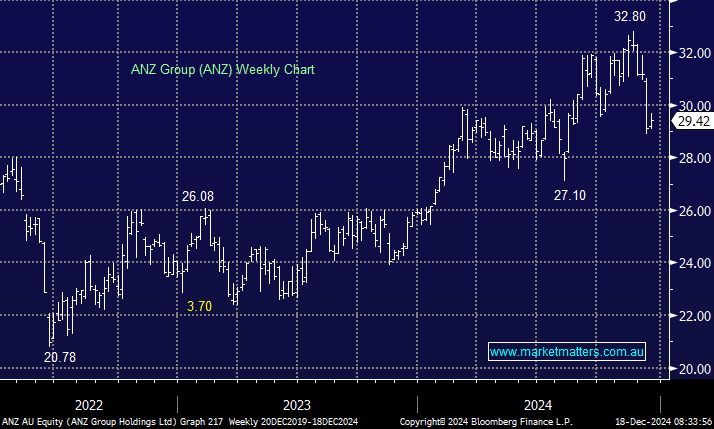

ANZ is up 15.2% pre-dividends over the past year, a return many would be happy with, however, it has underperformed CBA and WBC by a significant 30%.

ANZ is trading at less than half the earnings multiple of CBA, on a PE of 12.7x versus 26.7x for CBA. ANZ is trading at a 24% discount to the group average against a historical discount of 11%. CBA now trades at a 60% premium to the group relative to a 39% premium over time.

CBA trades on 3.7x book value while ANZ trades on 1.3x BV. The book value is the difference between total assets and liabilities; banks often trade at less than 1x book. When we hear analysts talk about CBA being the most expensive bank in the world, this is why. For international context, the most expensive bank in the US trades on 1.8x BV with Wells Fargo (WFC US), which we recently sold in the International Equities Portfolio, trading on 1.3x. In the UK, HSBC trades on 1x.

- While the dynamics in international markets are different, the message is clear. CBA is extraordinarily expensive, but ANZ has returned to a reasonable valuation.

According to consensus, CBA is forecast to yield 4%, including franking, for the next 12-months (ex-dividend in February), while ANZ is forecast to yield 7.8% inclusive of franking (ex-dividend in May).

Outperformance is not a new phenomenon for CBA relative to the other banks, and there are fundamental reasons for it. They’ve executed better, they have better financial metrics and better technology and they operate in an environment where scale matters; being big has proven a major advantage. ANZ, on the other hand, have failed at international expansion, operated with a myriad of complexity, and has just bought Suncorp’s (SUN) banking arm. International expansion was clearly a mistake; however, that has now largely been fixed, the bank has been simplified, and importantly, the Suncorp acquisition will help with scale.

The most recent news to hit the stock was the resignation of CEO Shayne Elliott with the appointment of an international candidate, Nuno Matos who was most recently CEO of Wealth and Personal Banking at HSBC. The appointment of an executive with offshore experience has clearly created some concern in the market about strategic direction – i.e., whether they will revisit past mistakes. We think this is overblown and believe his focus will be on bedding down Suncorp and continuing the simplification work of Elliott.

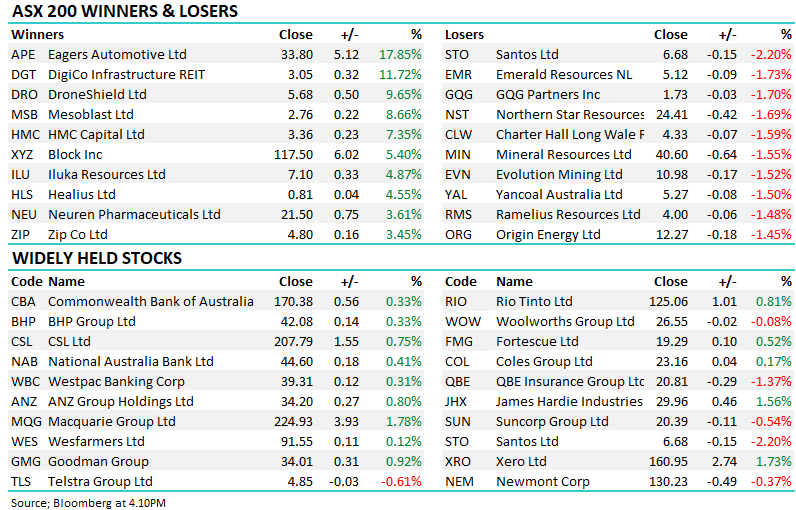

- We own CBA on the Income Portfolio with a 6% portfolio weighting and view it as extremely expensive, yet momentum is hard to argue with. We are likely to reduce this to a 5% target weight in the first instance, and initiate a position in ANZ into recent weakness.