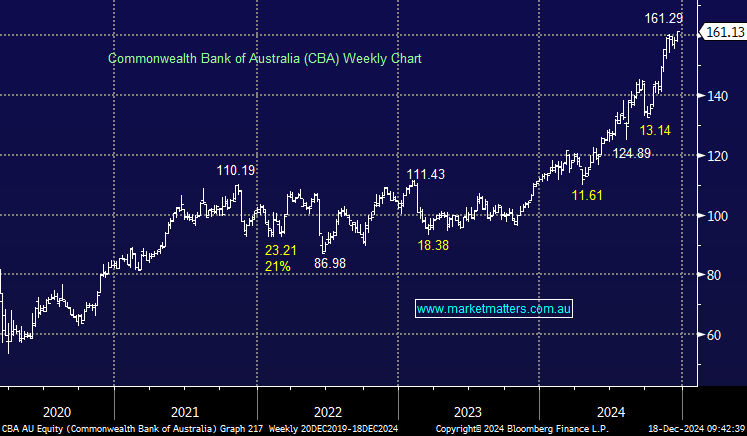

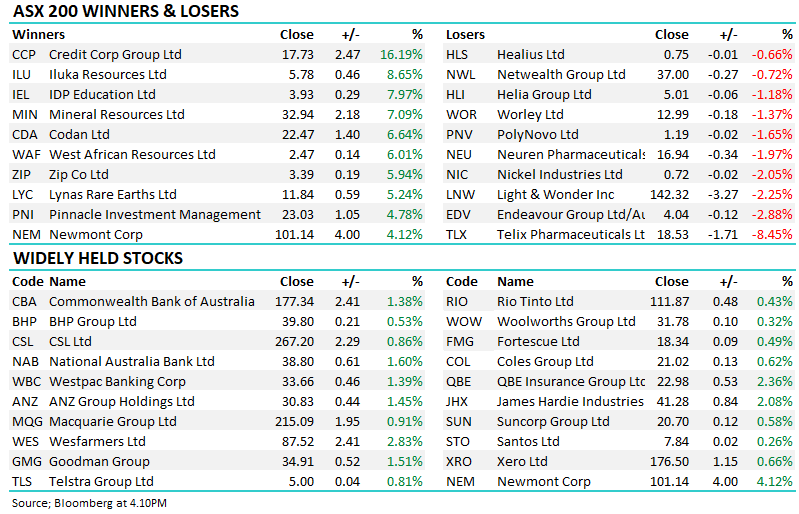

We are tweaking our exposure to banks in the Income Portfolio, trimming CBA back to a 5% portfolio weighting. While we have a 6% target weighting shown in the portfolio, capital gains have been solid, and this alert serves as a reminder around being active in managing weights as stocks move.

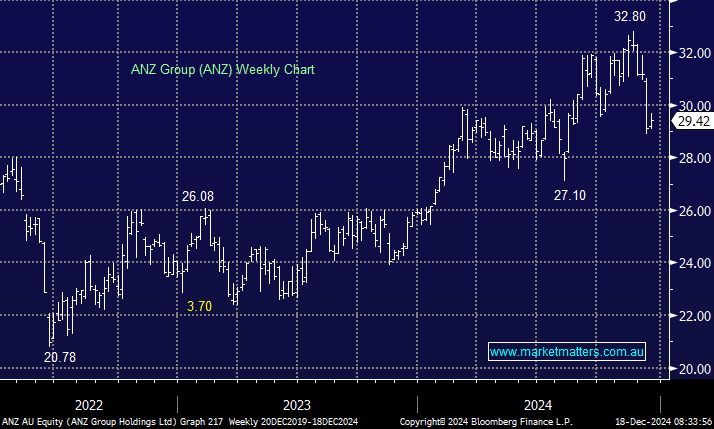

We are using weakness in ANZ to initiate a position in the Income Portfolio. We’re underweight bank equity (though we hold Hybrids) and view the relative value on offer in ANZ as appealing, following a ~10% pullback in the stock.