This predominantly Met Coal miner has bounced over 35% from its April low although similar to the underlying commodity the trend is still down. The company is delivering operationally, and is on track to meet FY25 guidance; the stock needs the Met Coal price to bounce, or at least stabilise. The company reported a $328 million profit for the first half and rewarded shareholders with a $72 million buyback. After strengthening its balance sheet, it’s well-positioned for when the commodity turns. We thought it was very positive to see Australian Super invest in WHC, a move the superannuation giant insists is consistent with its commitment to net-zero emissions by 2050, and our take on its position in the ESG evolution.

WHC has positioned itself perfectly for when the coal price recovers, having evolved the business to primarily focus on coking coal mining following the acquisition of Daunia and Blackwater. It’s been a tough journey over recent years, but we remain comfortable with our fundamental reasoning, just not the share price! Expect additional information on capital management at the upcoming result.

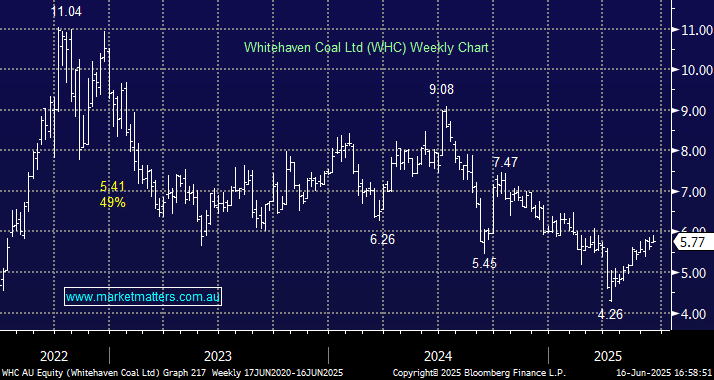

- We are initially targeting a retest of the $7 area through 2025: MM holds WHC in its Active Growth Portfolio.