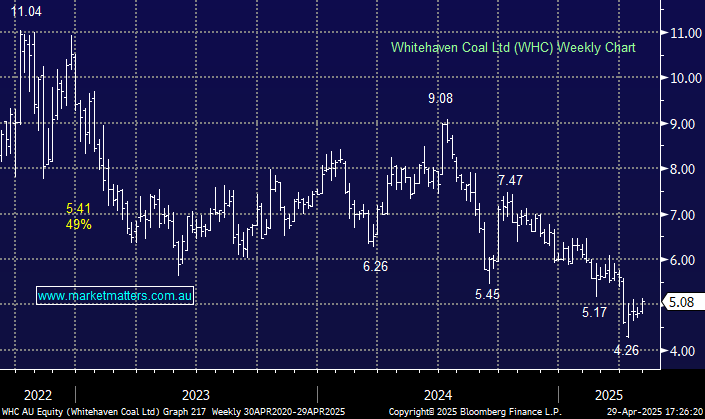

WHC +4.74%: Delivered a strong March quarter, tracking toward full-year guidance for FY25.

- Managed Run Of Mine (Rom) coal production 9.19 million tons

- Managed saleable coal production 7.39 million tons, -5.6% q/q

- Total managed coal sales 7.00 million tons, -22% q/q

Management reiterated that even with recent weather-related supply disruptions creating some upward price pressure, soft pricing is likely to continue short-term across both metallurgical and thermal coal. However, with coal production outlook reaffirmed at the high end of 35 million to 39.5 million tons and cost of coal now at the lower end of the $A140-$A150 per tonne, the business is positioned well. Spot coking coal sits at ~US$190/t as Indian steel mill interest has re-emerged with Indian steel production up 6.85% year-to-date providing a strong tailwind for prices.