- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX rallied to finish near the 9000 level and within reach of all-time highs – the majority of gains driven by the major banks and miners as upbeat sentiment from a strong start to the U.S. earnings season spilled over into the local market. The Big Four led the charge on renewed optimism around credit growth, while gold miners benefited from another surge in bullion prices.

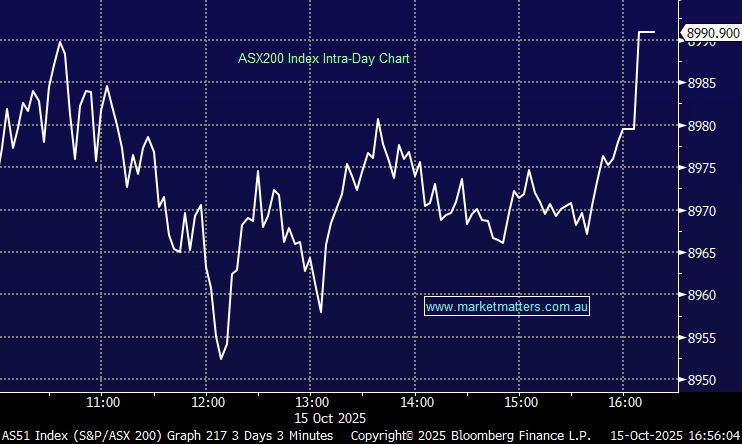

- The ASX200 rose +91pts/+1.03% to close at 8990.

- Healthcare (+2.07%), Materials (+1.46%) and Financials (+1.24%).

- Energy (-0.06%) the only sector to finish lower, Staples (+0.17%) and Property (+0.17%) underperformed the broader strength.

- Westpac (WBC) +2.0% led the financials higher after APRA lifted a $500m capital penalty on Westpac linked to its money laundering breaches, while CBA’s CEO Matt Comyn secured a new three-year contract extension.

- Commonwealth Bank (CBA) +1.5%, National Australia Bank (NAB) +1.9%, ANZ +0.5% were also higher, driving majority of the index gains.

- Bank of Queensland (BOQ) +1.4% rallied after posting a 12% rise in full-year profit to $383m and lifting its final dividend to 20¢ per share, with stronger commercial lending offsetting mortgage softness.

- BHP +1.8%, Fortescue (FMG) +2.1% and Rio Tinto (RIO) +1.8% all advanced alongside firmer iron ore prices, with miners also buoyed by optimism around infrastructure and resource spending in China.

- Gold producers gained after bullion hit a new record at US$4,185/oz, with Newmont (NEM) +1.5%, Perseus (PRU) +1.2% and Northern Star (NST) +1.1% among the standouts. UBS raised its long-term gold price forecast to US$3,250/oz, citing de-dollarisation and ongoing geopolitical risks.

- Telix Pharmaceuticals (TLX) +16.3% surged to $16.70 after upgrading its FY25 revenue guidance to $800–$820m, well above prior forecasts, driven by stronger-than-expected demand for its cancer imaging and treatment products.

- DroneShield (DRO) -9.6% slipped despite unveiling its new DroneSentry-C2 Enterprise software platform, which has already secured a European defence customer order.

- Evolution Mining (EVN) -2.9% eased after its quarterly update confirmed softer production of 174,000oz of gold at an AISC of $1,724/oz but did reaffirm FY26 guidance.

- Orora (ORA) traded flat as management admitted its $2.2b Saverglass acquisition had underperformed, though outlined potential turnaround, starting with cost savings via a restructure.

- Seven West Media (SWM) +1.8% and Southern Cross Media (SXL) -0.6% moved in opposite directions as the ACCC launched a probe into their proposed merger over competition concerns.

- Asian markets were higher, China +0.5%, Hong Kong up +1.5% and Nikkei +2.1%.

- Gold traded higher to all-time highs during the session to $4186/oz around the close.

- Iron Ore in Singapore traded down 1%, now trading $104/mt at our close.

- US futures are up +0.3%.