- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

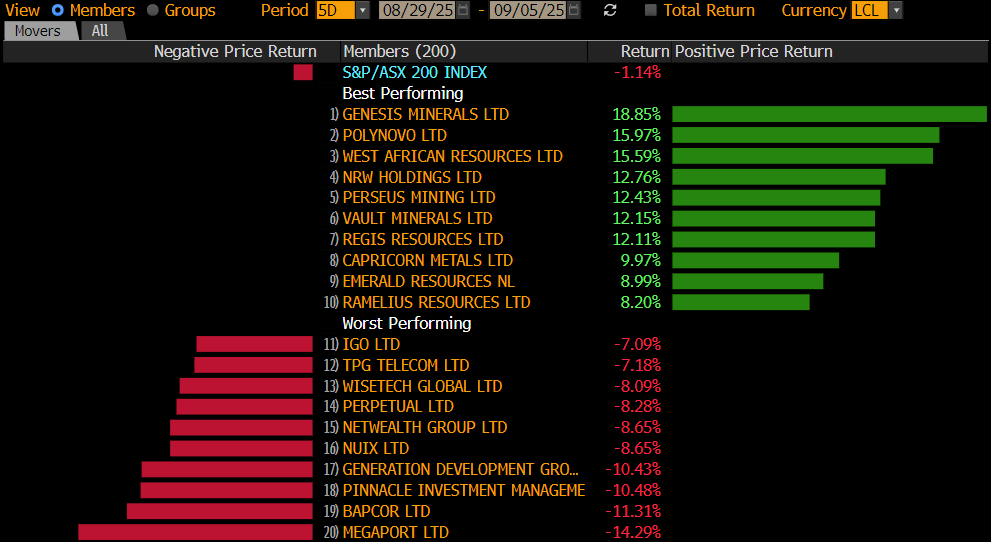

The ASX moved higher on Friday though it was one of quietest sessions in recent memory trading in a narrow ~15pt range beyond the open, with next to no news flow to drive individual share prices in the wake of the blockbuster reporting season just gone. Gains in retail, tech and gold were the highlights, yet the overall move was muted and despite the rebound over the last two sessions, the index suffered its biggest weekly decline since March down -1.14% over the period and snapping a 4 week streak of closing higher.

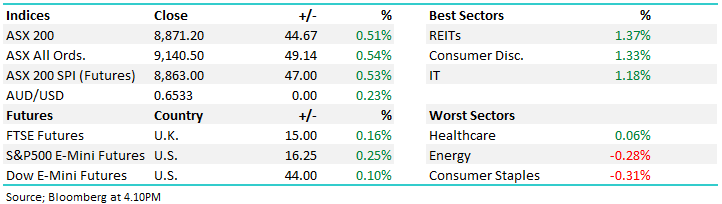

- The ASX200 rose +44pts/+0.51% closing at 8871.

- Real Estate (+1.37%), Consumer Discretionary (+1.33%) and Technology (+1.18%) the strongest.

- Consumer Staples (-0.31%) and Energy (-0.28%) the weakest links.

- National Australia Bank (NAB) +0.84%, Westpac (WBC) +0.71% and ANZ Group (ANZ) +0.27% firmed while Commonwealth Bank (CBA) +0.08% was flat, supporting the index move.

- Retailers had a great session across the board after solid local economic data this week, Premier Investments (PMV) +2.25%, Harvey Norman (HVN) +1.09%, JB Hi-Fi (JBH) +1.78% were all higher.

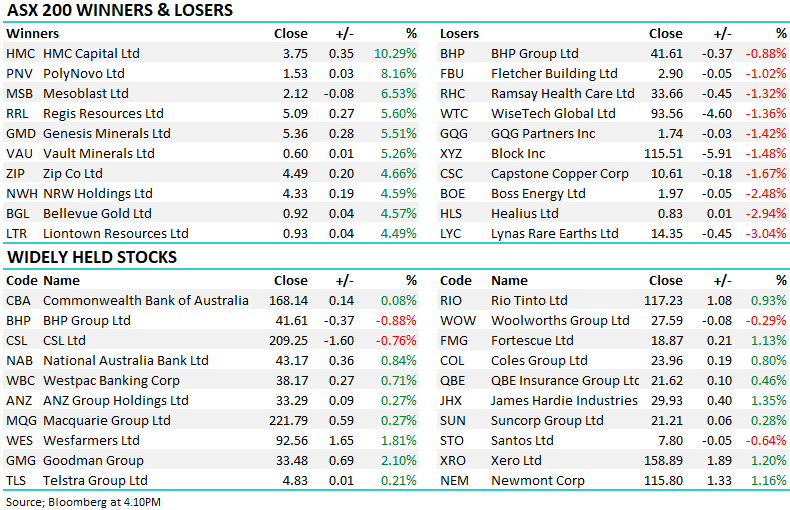

- HMC Capital (HMC) +10.29% was the best performer in the ASX 200 today, though we’re still looking out for why, expecting some news here shortly.

- BHP (BHP) -0.88% fell even while iron ore held steady, while Rio Tinto (RIO) +0.93% and Fortescue (FMG) +1.13% moved higher.

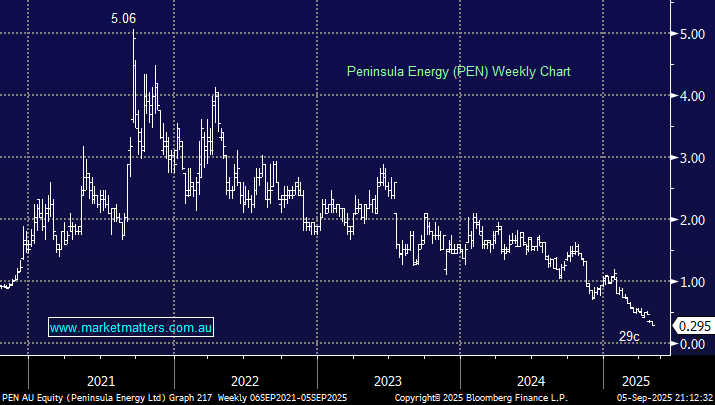

- Gold names rallied near record bullion levels – Regis Resources (RRL) +5.6%, Genesis Minerals (GMD) +5.51%, Bellevue Gold (BGL) +4.57% and Perseus (PRU) +3.66% the strongest.

- Orica (ORI) +1.2% provided a business update and was up 5% on the open but quickly retreated as the chemical and explosives manufacturer flagged stronger second-half earnings momentum.

- Qantas (QAN) +0.59% edged up after the airline said CEO Vanessa Hudson’s bonus would be cut following the recent cybersecurity breach – good optics on corporate governance for the airliner for once!

- Gold was trading near all-time highs $US5 to $US3551/oz around the close.

- Positive trading in Asia, Hong Kong rallied +1.5%, China was 1.2% while Japan was up +1%.

- Iron Ore in Singapore was up 0.2%, around $US105/mt at our close.

- US futures are all higher – Dow Jones +0.1%, S&P500 +0.2% and Nasdaq +0.4%.