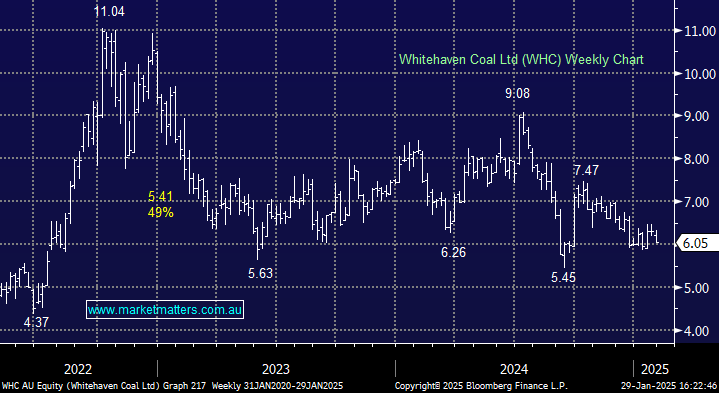

WHC flat today, traded strongly out of the gates but settled later in the session as the coal producer reported good December quarter production and sales volumes.

- Production in line with September quarter at 9.7mt.

- Total equity coal sales rose to 7.8mt, up 22% from the prior quarter.

- Production and coal sales expected to reach the upper half of FY25 guidance range.

- Costs trending toward the lower end of FY25 guidance.

- Net debt stood at A$1.0bn at quarter-end, with US$1.08bn due from the sale of its Blackwater asset expected in April.

WHC remains on track to deliver a stellar full-year result, though we are conscious of noise in the energy space affecting the coal price. The business is well capitalised, particularly post-April, with flexibility to return capital to shareholders via buybacks or dividends.

- We hold WHC in the Active Growth portfolio