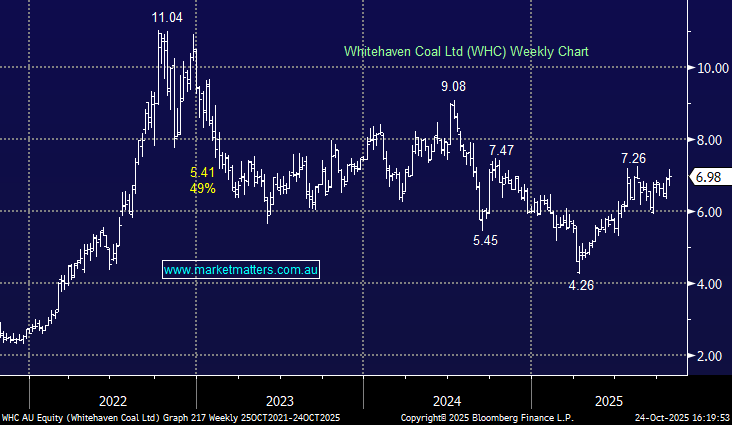

WHC -0.43% traded in a big range, though closed only mildly lower after posting a softer first-quarter production update, with weaker volumes and lower realised prices offsetting modest sales growth.

- Managed ROM coal output came in at 9.05Mt, down 15% q/q and 7% y/y, reflecting weather disruptions at NSW open-cut operations.

- Saleable production fell 5.4% q/q to 7.33Mt, while coal sales lifted 4.3% q/q to 7.76Mt, aided by improved output from Narrabri following its longwall move.

- Revenue dropped to $510m from $634m a year earlier, with the mix split 56% metallurgical and 44% thermal coal.

- FY26 guidance was unchanged, targeting 37–41Mt of ROM coal and costs of A$130–145/t.

A decent operational quarter given challenging conditions, though near-term earnings headwinds persist with prices subdued.