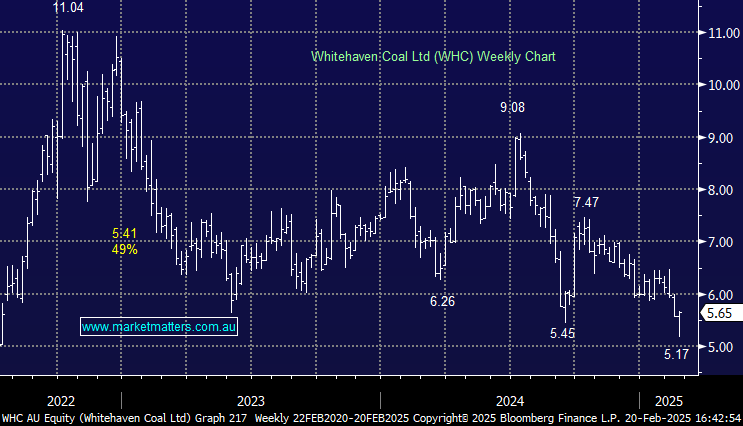

WHC +8.86%: Rallied on the back of a solid 1H25 result this morning with earnings ahead of expectations on strong cost discipline, guidance was good and they’re reviewing their capital allocation framework at the FY in August.

- Revenue $3.43 billion vs. $1.59 billion y/y, estimate $3.39 billion

- Underlying profit $328 million, -13% y/y, ahead of $278.5m expected

- Underlying Ebitda $960 million, +52% y/y ahead of $870m expected

- Interim dividend per share $0.09 vs. $0.07 y/y

The talked to a cost out program which should deliver a run rate of $100m p.a. of savings in Queensland by the end of FY25 and said they’ll undertake a review of their capital allocation framework, including current dividend payout ratio and share buy-back status, post Blackwater sale proceeds and with a full year of FY25 operating cash flows. All being equal,we would expect the resumption of higher dividends.

Guidance for unit cost and capex remained unchanged but unit costs in 1H FY25 of $137/t are tracking at lower end of cost guidance range of $140-$155/t. Capex guidance also tracking at lower end of guidance range.

Further, WHC will resume its share buyback allocating up to $72 million of capital to buy back shares over the next six.

- A good result with WHC managing what they can very well, just weakness in coal prices are weighing.