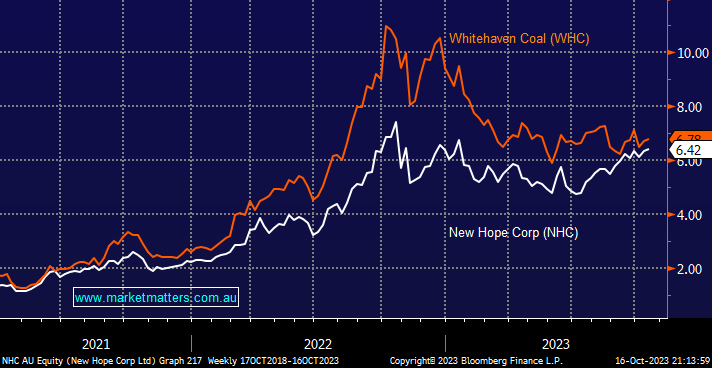

Two ASX coal companies with very different fortunes through 2023, WHC has fallen -28% while NHC has risen +2%, and that trend continued on Monday with NHC outperforming by +0.4% although both closed higher. The huge difference in relative performance has been driven by management-flagged direction over the coming years:

- Whitehaven Coal (WHC) $6.78 – is focusing on growth after suspending its buyback to bid for BHP’s QLD coal mines, with a price tag of ~$5bn the company looks set to disappoint investors in search of yield and capital management – we are long in our Active Growth Portfolio.

- New Hope Corp (NHC) $6.42 – have flagged future capital management will include fully franked dividends, on-market buybacks and other capital returns, i.e. almost the opposite to WHC – we are long NHC in our Active Income Portfolio.

We can see both stocks heading towards $7 into Christmas, but for WHC to start to outperform, we need to see the market adopt our more positive outlook toward fossil fuels over the coming years.