WHC -5.73%: 1H24 was always going to be a reality check relative to this time last year given the fall in the coal price, however, throw in a large acquisition that is looking to complete in April and safe to say, MD Paul Flynn had a lot on his plate this half.

Financial metrics were softer than hoped, revenue was a shade light on at $1.59bn, down -58% y/y and against consensus of $1.62bn, while underlying earnings (EBITDA) of $622.8m was a 9.5% miss vs expectations for $688m. The dividend of only 7cps was a talking point, a long way from the 29cps expected, however, it makes total sense to MM for them to concentrate on their balance sheet after making a large acquisition and taking on $1.1bn in new debt to fund it. In terms of coal pricing, they said 1H, high-CV thermal coal prices moderated but remained resilient, and they realised an average price of A$220mt.

Regarding future dividends, the focus remains on franked dividends within the targeted payout ratio of 20-50% of NPAT generated from existing operations (i.e. excluding the acquired Assets). The earnings from the acquired assets will be used to pay down debt in the first instance, so, the takeaway is that we should expect lower dividends for the foreseeable future.

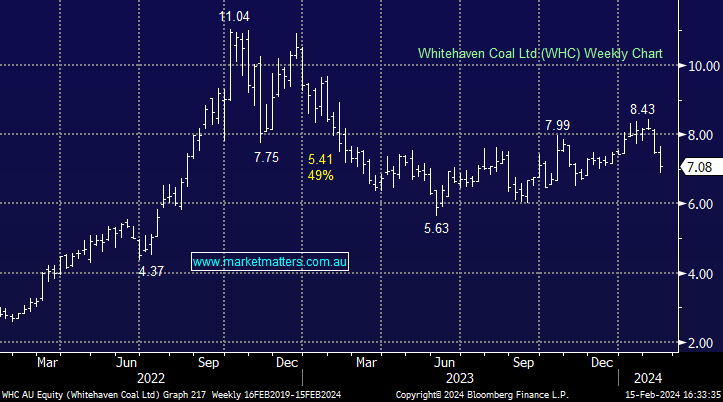

- Overall, a softer-than-expected result with the share price mirroring the miss in earnings for the period.