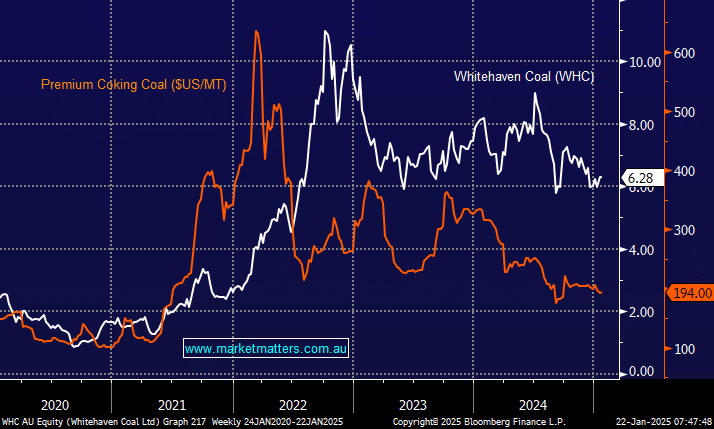

WHC has effectively been getting ‘longer coal’ as the market has been under pressure and this has transformed it from a cash cow into a company where free cash flow and dividends have come under significant pressure, and the stock has performed accordingly. While the coal price is hard to forecast, we do note that analysts are almost universally bearish on their assumptions, and we see scope for prices to top low expectations. More importantly, it’s the expected change in free-cash flow over the coming year as capex subsides that should bring back some interest towards WHC.

WHC transformed itself last year to primarily a coking coal miner when it acquired Daunia and Blackwater, and management has been transparent that the next few years will be focused on bedding down the acquisitions instead of further M&A. As of September 30, net debt was A$1.2bn with US$1.08bn of proceeds from the Blackwater selldown expected in Q3 FY25. They do have some contingent/variable payments to BHP starting in July, but these are significantly lower than they could have been.

We are fans of the move by WHC, but it’s necessitated some patience towards our position. In the coming years, the dividends should return, especially if the coal price turns. Being long coal via Whitehaven has tested our patience, with dividends offsetting the share price decline, but the correlation between WHC and the fossil fuel is strong, and if/when coal turns, WHC should follow in earnest.

- We are looking for WHC to test $9 in the next 1-2 years. MM is long WHC in our Active Growth Portfolio.