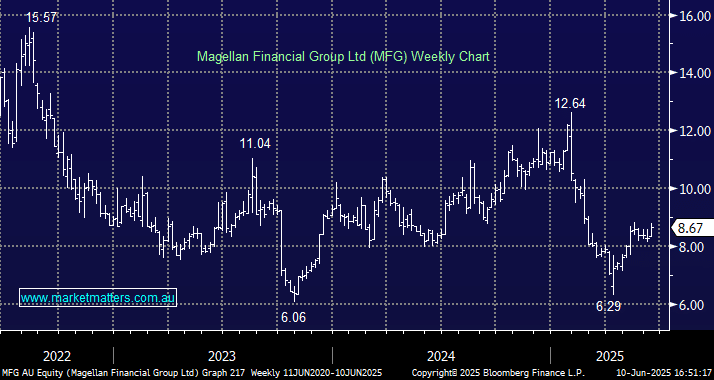

The global fund manager is gaining momentum in terms of share price, and is threatening to breakout of its recent trading range. We believe MFG could trade materially higher in the coming months as better performance and lower-than-expected outflows meet a depressed valuation. MFG reported fund flows last week, and while they still saw FUM leave ($400m), it was lower than we (and the market) thought, given January’s resignation of Head of Infrastructure Gerard Stack after 18 years. The expectation at the time was that Gerard’s departure would see significant outflows from the infrastructure unit, which accounts for over 40% of MFG’s FUM. This concern led the stock to trade from mid-$12s down to $9 before the April turmoil set in, pushing the stock down to a low of $6.29.

- While the stock has recovered to pre-liberation day levels, it’s still trading at a material discount to longer-term averages, in our view, on the expectation of higher outflows than what’s materialising.

MFG is trading on an Est P/E of 11.8x, below its 5-year average of 14x. We have written before about the impact of stripping out its cash and principal investments, which, on UBS numbers, pushes the P/E of their funds business to just 5x, or in other words, ~70 % of their $1.5bn market cap is underpinned by cash & investments. Putting that aside, and comparing its valuation relative to the ASX 200, MFG has historically traded at 0.82x the ASX 200 multiple, versus its current valuation of 0.62x. When we scour the market for relative value opportunities with a catalyst the see the valuation gap close, MFG stands out.

If FUM proves stickier than the market thinks, and that’s certainly what we’re seeing currently, MM is confident the market will start to apply a higher multiple to MFG against a backdrop of rising asset prices. Investment performance saw FUM increase last month to $39.3bn despite the outflows. From an income perspective, MFG’s forecasted yield of ~6.5% is also very appealing.

- We reiterate our bullish stance on MFG, expecting shares to continue to climb higher, targeting a move back towards $11, or ~25% higher. MM holds MFG in the Active Income Portfolio.

Accordingly, we have added MFG to the hitlist of our Active Growth Portfolio, having exited the stock in December at around $11.20. We believe the stock is a great undervalued quasi-bullish play on the ASX as it posts new highs, plus it comes with an attractive yield, just when the RBA is poised to cut the official cash rate down towards 3%.