Hi Sidney,

GCI is the Gryphon Capital Income Trust which invests in mortgaged backed securities targeting a rate of return at the RBA cash rates +3.5%. The risk is that if the assets that underpin the NAV have not yet priced the current economic climate and that there is a lag effect before this is shown via the NAV. That’s the risk however we’ve seen before that liquidity can drive big discounts in these securities which ultimately create opportunity. Our favoured in this space is MXT which is 15% below NAV.

We liked the NAB Hybrid at the time of issue. It’s a standard tier 1 bank hybrid and demand was very strong. The bookbuild was something like 2.5x oversubscribed from what I hear. Since then though, credit markets have changed, spreads have increased and this note is likely to open a few dollars below the $100 issue price.

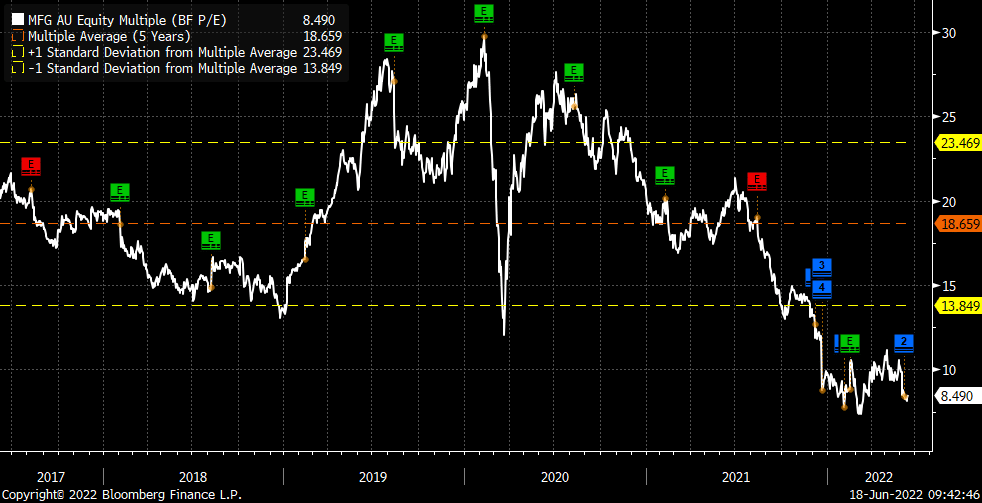

Magellan (MFG) at $30 depends on the multiple the market is prepared to pay for it. On its historical P/E of 18.7x, it’s worth $27.41. Currently it is being priced on 8.5x. $30 we think is a stretch, but possible if they start attracting FUM again.