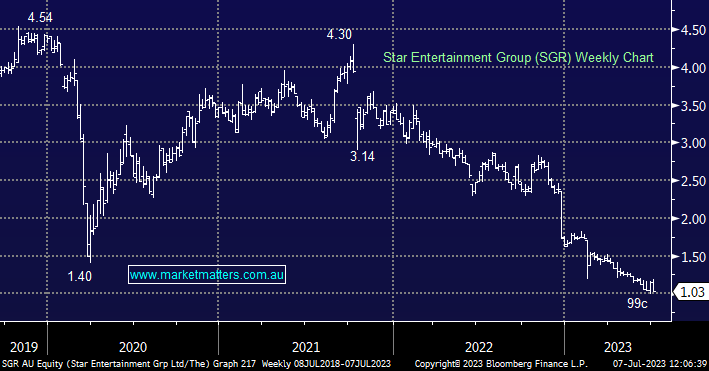

Are MFG & SGR still two titillating turnarounds?

1. MFG: Given today's FUM update and your comments in today's afternoon report, including about the update not meeting your expectations on FUM/performance fees: (A) Notwithstanding your comment that you are long and bullish MFG, do you advise a more cautious approach now to entering the stock if not already a holder - and at what levels? (B) Given current FUM trends, and that you state you were expecting FUM to be better, not worse, please elaborate on your view that: "Overall, the business is turning, though perhaps not as fast as we had hoped." 2. SGR: Given today's performance and your comments about concerns around their balance sheet and refinancing of debt, do you still think SGR provides attractive risk-reward and do you remain bullish toward SGR under $1.20?