The US market started its post-Easter trading in a quiet fashion ahead of tonight’s important US CPI inflation which will have a huge impact on the Feds future path for interest rates. The consensus is for CPI Inflation MoM to be +0.2% for March & 5.1% YoY which is a big drop from 6.0% at last month’s print and would be the 9th consecutive month of declines since inflation hit 9.1% in June 2021. i.e. this is clearly trending in the right direction.

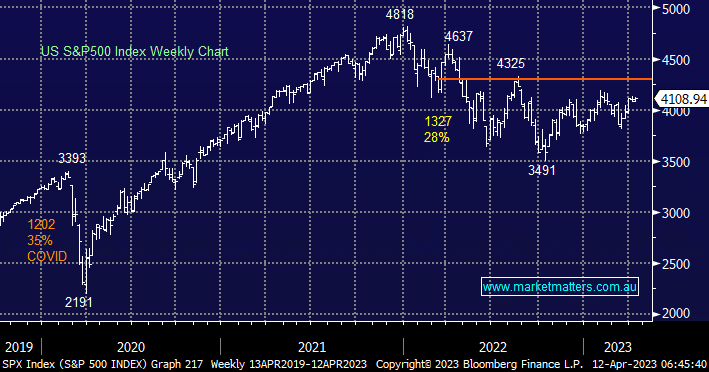

Overnight the S&P500 actually closed unchanged while the NASDAQ slipped -0.7% taking its pullback to 5 consecutive sessions as traders mulled the likelihood of another rate hike, the policy-sensitive US 2-years rose back above 4% ahead of the CPI – it feels like we’ve seen some book squaring ahead of the data.

- From a risk/reward perspective we are now leaning towards selling strength as opposed to buying weakness as indices approach our target areas.

- While we are still net bullish short term any advance is likely to be choppy as we monitor for signs of the May effect weighing on sentiment.

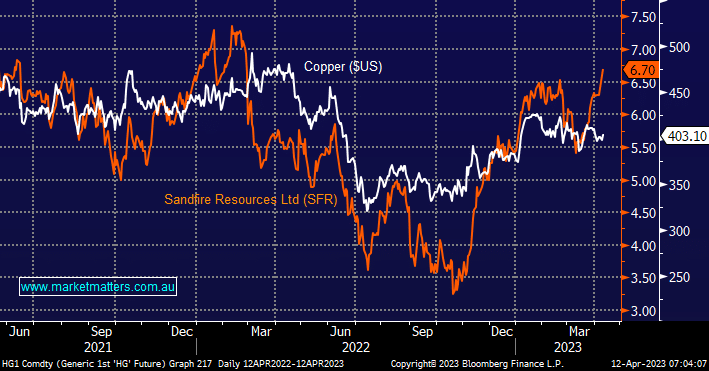

The IMF cut its global growth forecasts last night but they appear to be well behind the market’s thoughts as copper actually rallied +1.3% but it still remains over 7% below its 2023 high as recession fears overhang financial markets. A couple of interesting and relevant facts caught our attention this morning:

- Copper is holding firm around the $US400 level even as recession fears grow – at MM we believe the underlying demand will drive prices above this year’s high.

- The takeover of OZ Minerals (OZL) by BHP has propelled Sandfire (SFR) back into the limelight as a domestic copper play and it made fresh 11-month highs yesterday, even with copper treading water.

We like SFR but after its stellar run we are considering alternative plays in the quality Australian miners.