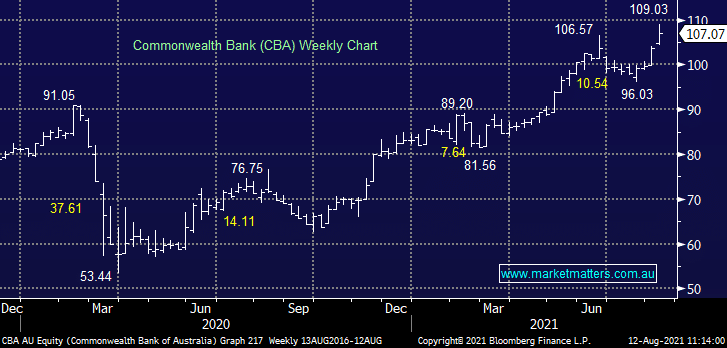

We are trimming our 7% holding in Commonwealth Bank (CBA), reducing it by 2% leaving a 5% weighting.

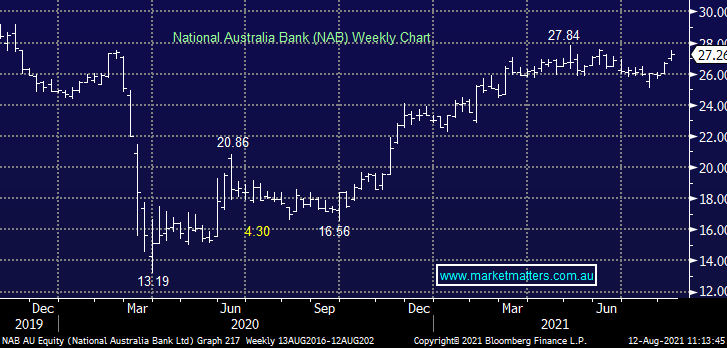

We are trimming our 7% holding in National Bank (NAB), reducing it by 2% leaving a 5% weighting.

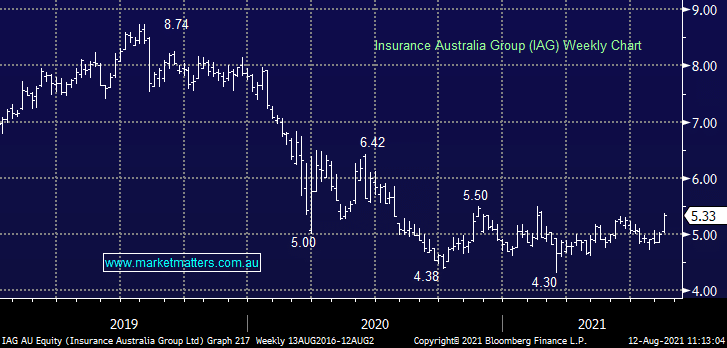

We are buying IAG. We view the stock as cheap with a strong chance for near term upside as discussed in recent notes.

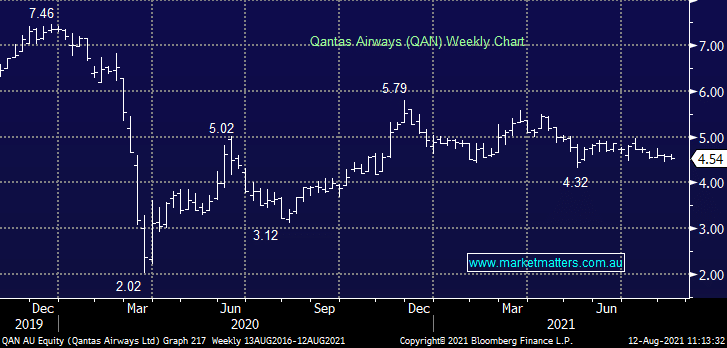

We are buying Qantas (QAN). We have very little exposure to the re-opening trade and we view QAN as a strong candidate here having used the pandemic to make profitable changes to their internal structures.