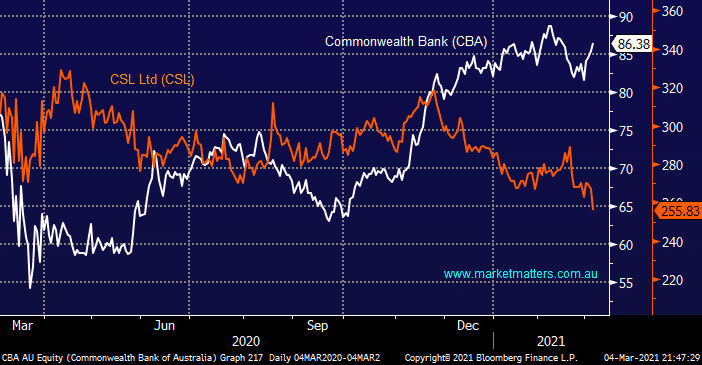

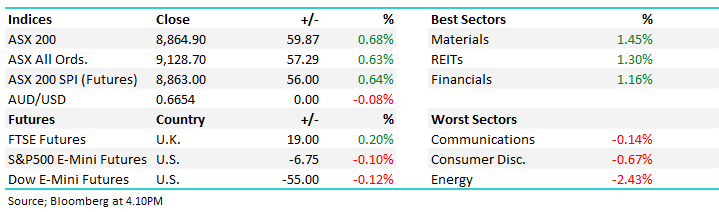

The performance elastic band that’s defined Australian stocks over recent months is perfectly illustrated by the largest 2 companies on the ASX : CBA and CSL. Overall this shouldn’t be a major surprise with the former benefitting from rising bond yields and vice-versa but with our view that yield appreciation is due a decent rest, this is likely to flow through to stock / sector performance implying some reversion feels close at hand. MM believes the CBA – CSL elastic band has further to stretch but it does feel reasonably mature for this stage of the move.