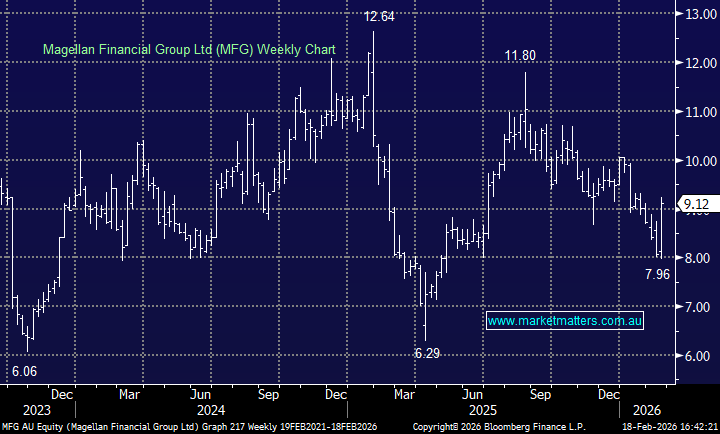

MFG +12.18%: The fund manager delivered a stronger 1H result, with earnings beating expectations despite lower revenue and stable funds under management. The interim dividend was lifted sharply, highlighting capital strength, and that’s what got the market rocking and rolling today.

- Operating profit $83.1mn, broadly flat YoY but ahead of expectations ($73mn)

- Total revenue $121.0mn, -32% YoY

- Investment management revenue $106.9mn, -17% YoY

- Average FUM $40.2bn, +5.6% YoY

- Interim dividend 39.5cps (vs 26.4c YoY)

Management continues to focus on diversifying earnings and maintaining discipline in a challenging environment for active managers, with MFG materially underperforming in their flagship global fund, down -5.7% versus a +6.5% rise in the benchmark over the past year. Not a great outcome. Dividend support is welcome and so is their more diversified model, but performance in the flagship strategy remains underwhelming. MFG is a cheap, high yielding stock, but FUM performance needs to improve.