- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

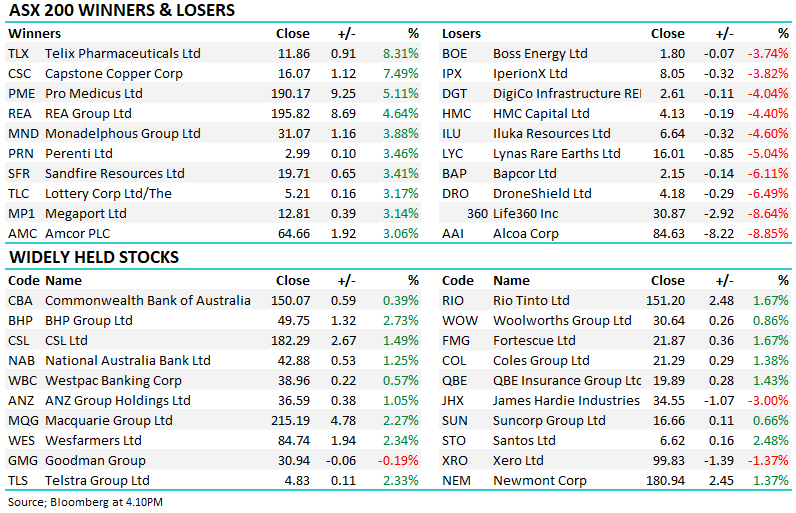

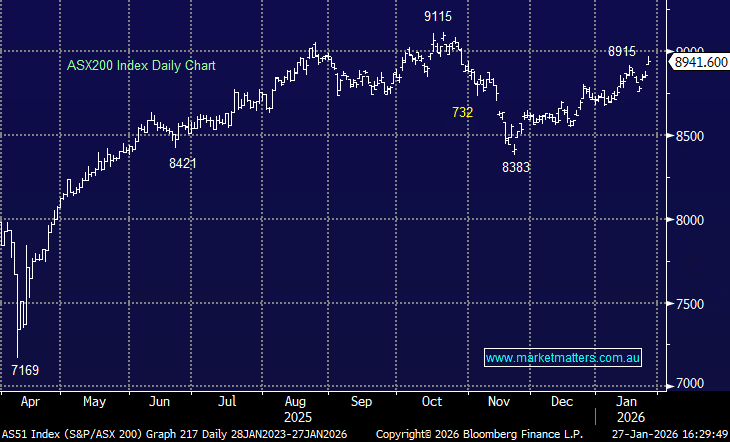

The ASX closed higher after a day off, buoyed by a powerful rally in precious and base metals stocks, with gold climbing to yet another all time high, now seemingly setting a new record every day, and Copper stocks chipping in too. While geopolitical noise remains in the background, the session had a risk-on feel as the rotation into resources showed no signs of slowing down with the index closing at its highest level since October.

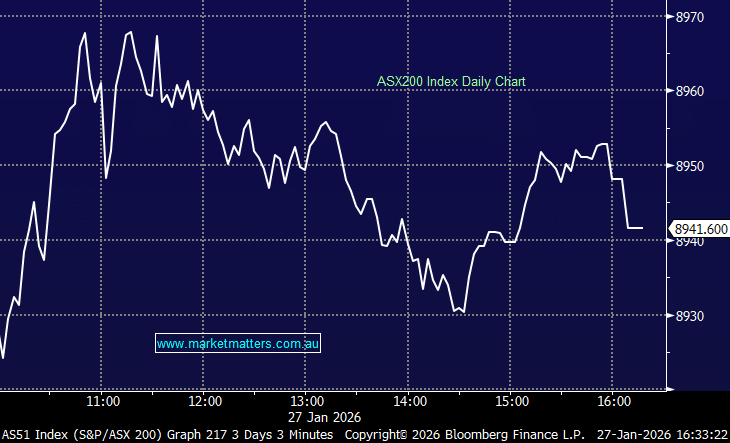

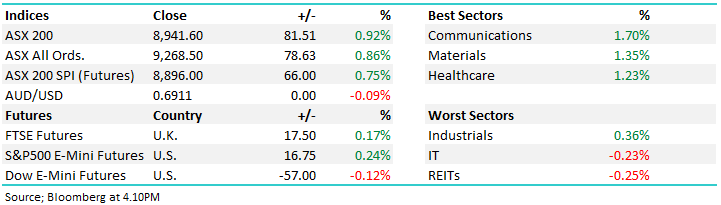

- The ASX200 added +81pts/+0.92% to close at 8941.

- Communications (+1.7%), Materials (+1.35%) and Healthcare (+1.23%) led the line.

- Real Estate (-0.25%) and Technology (-0.23%) the only two sectors lower.

- Resource stocks led the rally as gold and silver pushed to fresh record highs, with bullion touching US$5100/oz and silver topping US$114/oz.

- Silver stocks continued to keep pace with moves in gold – Silver Mines (SVL) +6.2%, had a strong session.

- BHP Group (BHP) +2.7%, reclaiming its spot as Australia’s largest listed company for the first time in 18 months, trading above $50 in early trade, Rio Tinto (RIO) +1.7%

- Capstone Copper (CSC)+7.5% in the copper space the index’s top performer, though now everything enjoyed the bullish session – family tracking app Life360 (360) -8.6% and aluminium producer Alcoa (AAI) -8.8% were the biggest drags on the index.

- Financials provided solid support, with all major banks finishing higher – Macquarie Group (MQG) +2.3%, National Australia Bank (NAB) +1.2%, Commonwealth Bank (CBA) +0.4%

- DroneShield (DRO) -6.5% fell despite doubling December-quarter revenue – future orders are on the light side.

- Fortescue Metals (FMG) +1.7% after acquiring remaining shares in Alta Copper for approximately $150mn.

- Metcash (MTS) +1.2% following the appointment of a new CEO for its food service and convenience business.

- Karoon Energy (KAR) +0.3% rose despite lower quarter-on-quarter output.

- Michael Hill International (MHJ) +5.4% after delivering a stronger half-year result.

- AUB Group (AUB) halted on a $400m institutional placement to fund a UK acquisition.

- Santos (STO) +2.5% after shipping its first LNG cargo from the Barossa project.

- Cyclopharm (CYC) +20% after receiving a major endorsement for its Technegas ventilation product, leading US medical bodies.

- The Aussie dollar climbed to US69.40¢, nearing a three-year high, on growing expectations the RBA could lift the cash rate as soon as next month.

- Gold was up ~$63/oz during the session, trading at US$5072/oz around our close

- Iron ore was higher, trading $US103.50/mt

- Asian markets were higher, with China up +0.2%, Hong Kong up +1% and Japan +0.8% higher.

- US futures are mixed, Dow -0.1%, the S&P500 +0.2 and Nasdaq +0.5%.