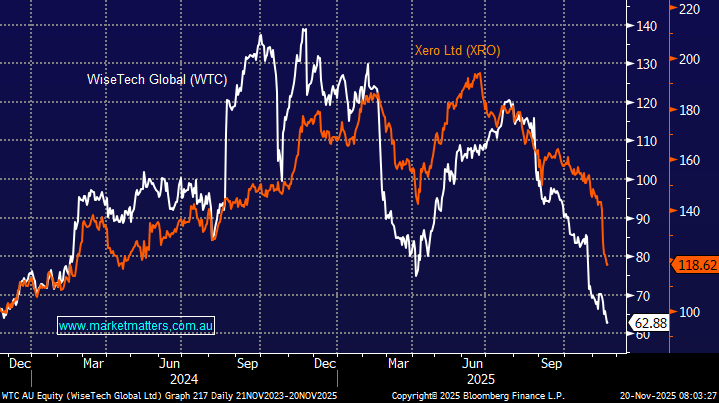

Both WTC and XRO have retreated further than we expected, having completed large acquisitions that are muddying the waters – especially with some extra spice on offer from Richard White & Co, while Xero had a challenging earnings release last week. These are two goliaths of the ASX tech space:

- XRO is a $20bn business that makes a profit and pays a dividend. Revenue is forecast to hit $NX2.7bn in FY26, with stronger acceleration in outer years as the Melio acquisition bears fruit.

- WTC is a $22bn business that has traded back to a very attractive valuation, on an EV/EBITDA multiple of 21x – it’s cheapest in recent history.

The runway for growth of these two companies is clearer and more mature – and both have come back to very attractive valuations relative to this likely growth. When stocks fall, it will always be for a reason, and both XRO and WTC have given the market a reason to sell – however, for those with a medium-term horizon, we believe both offer compelling value at current prices.