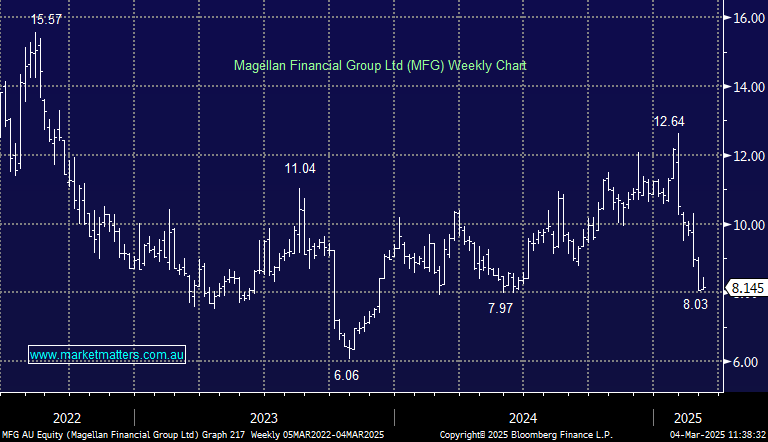

Magellan (MFG) has declined on the back of weaker results, plus a change in investment management personnel with the resignation of Head of Infrastructure, Gerald Stack. The stock has fallen from above $12 to around ~$8. We estimate MFG have $2.20/sh worth of cash/investments on their balance sheet, putting the funds management business on ~8x earnings. While the turnaround is taking more time, we expect a dividend of at least 6% fully franked while we wait. Further, we believe the market is underestimating their recent acquisition of Vinva and their strategic stake in Barrenjoey.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM are buying MFG in the Active Income Portfolio, allocating 4% around $8.14

Add To Hit List

Related Q&A

Magellan Financial Group (MFG)

GQG Partners Inc (GQG)

Magellan Financial Group (MFG)

Perpetual (PPT) and Magellan (MFG)

Magellan (MFG) does MM have a new target price?

MFG Departure

MFG and NXL

Magellan (MGF)

GARY stocks

Upcoming dividends and growth potential

Is Magellan (MFG) good buying?

Is Magellan (MFG) still a good option?

Thoughts on Magellan Options (MFGO)

What are MM’s current thoughts on Magellan (MFG)

MFG on active growth and income portfolios

Did you buy Magellan (MFG)?

Please explain the Magellan Options situation, i.e. MFGO

Fund Managers

Please explain BHP ADR pricing

Updated thoughts on Magellan (MFG) please

Is MM considering accumulating Magellan (MFG) around $9?

Your thoughts on TYR, MFG & CCP please

Can you explain the recent MFG share deal please

Why did MM not sell MFG after their poor result?

Are MFG & SGR still two titillating turnarounds?

Does MM see any upside in Magellan (MFG)?

MM should be helping Magellan (MFG)!

Do you have an updated view on MFG?

MM call to ‘Cut Losers’ like MFG, KGN, APX

GCI, MFG, NAB Capital Notes 6

Thoughts on Magellan (MFG)

Whats MM thoughts towards MFG Options?

Could MM explain MFG’s options proposal?

MFG

Updated view on MFG

Boral & Magellan under the microscope

Is it a good time to consider any of the fund manager companies?

Is it worth selling MQG and buying MFG?

Thoughts on new GQG float

Why has Magellan fallen so much?

Buying Magellan (MFG)

Using moving averages in analysis

MM thoughts on SIQ, PGH & MFG

Question on decline of MFG

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.