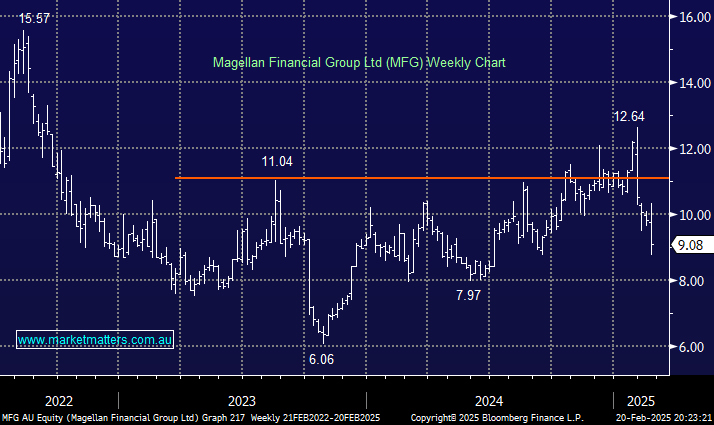

Australian fund manager Magellan Financial (MFG) was smacked over 10% on Thursday after its 1H funds management revenue declined by 1.1%, with a degree of fee compression catching our eye:

- Funds under management (FUM) revenue $129.8 million, down -1.1% and 4% below consensus estimates.

- Adjusted net income $84.1mn, down -10% YoY and ~17% below expectations.

- Average funds under management (FUM) $38.08 billion, up +3.2%.

- Interim dividend 26.4c v 29.4c Y0Y.

A couple of things are acting against MFG: FUM grew, but revenue is heading in the wrong direction, and investors are concerned that outflows could pick up following Gerald Stack’s recently announced departure. On the call, management confirmed they have not had any redemptions (or intentions to redeem) from infrastructure, though it’s obviously only early days and does present a risk.

However, we would argue that a lot of bad news is being built into MFG’s share price, and the business is more diversified than just their own funds; with Vinva, Barrenjoey, Finclear and Airlie within the Magellan stable. A yield of ~7% for the year ahead also looks attractive.