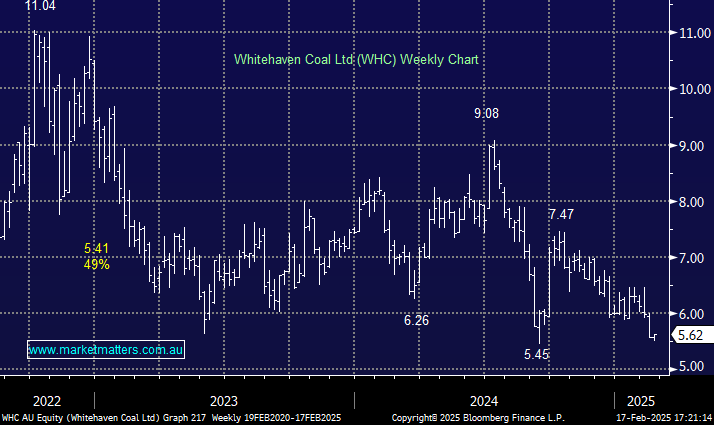

WHC was previously paying out high/attractive dividends prior to the $4bn purchase of the Daunia and Blackwater metallurgical coal mines from BHP and Mitsubishi last year. This curtailed dividends and when overlayed with a weak coal price, WHC shares are now trading back to historical support.

Looking forward, stronger dividends are becoming more likely now they’ve sold off 30% of the Blackwater mine for $US1.08bn to a strategic buyer, which will put them in a position to look at their dividend policy with a fresh set of eye’s come FY25 results in August.

We now expect WHC to pay a 5% fully franked yield this year, with risks on the upside even with a weak coal price. Investing in resource stocks for yield brings with it uncertainty around the underlying commodity price. Still, we believe coal prices have reached/are approaching their nadir, leaving WHC in a solid position to again become a strong dividend payer.

- We can see WHC regaining its mojo this year, initially testing $7: MM is long WHC in its Active Growth Portfolio.