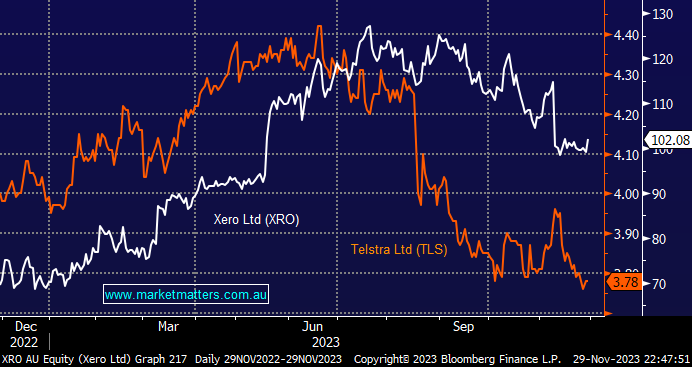

XRO has enjoyed a solid 2023, advancing +45% year-to-date, but the last few months have proved disappointing as the stocks corrected 20% following a soft report recently. We like the online accounting business, but valuation is always a concern, especially if/when we enter a risk-off period for equities. Conversely, Telstra (TLS) has drifted -5% this year. While it’s not many people’s favourite company, it has excellent, reliable earnings and dividend flow, making it an excellent defensive play after its more than 15% pullback.

- We are watching the elastic band between XRO and TLS carefully into Christmas.