NAB and WBC both delivered solid results this month. ANZ was a touch softer this morning at the profit line, although they beat with their dividend, plus a $2bn buyback should be supportive moving forward.

- We are mildly bullish on the banks and have no plans to reduce our current exposure – MM is long ANZ and NAB in our Active Growth Portfolio & NAB & CBA in our Active Income Portfolio.

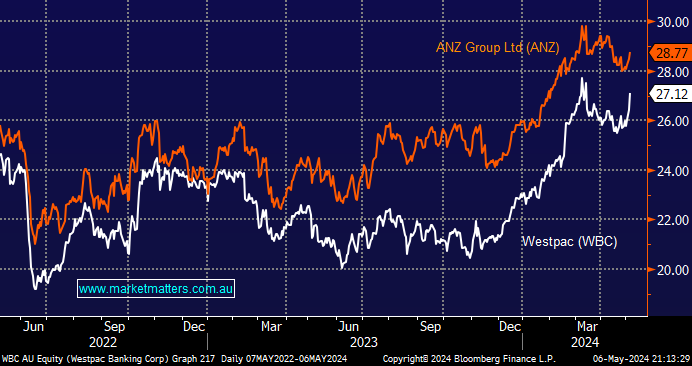

- However, we are now more conscious that ANZ has work to do, integrating Suncorp’s banking unit, while we were impressed with Westpac’s result. Specifically, we were surprised by the number of positive signs once we waded through the detail, with a sector-leading core profit outlook combined with significant near-term capital returns.

- We are actively considering a switch from ANZ to WBC or CBA, while Macquarie (MQG) is also back on the radar for our Growth Portfolio following its pullback.