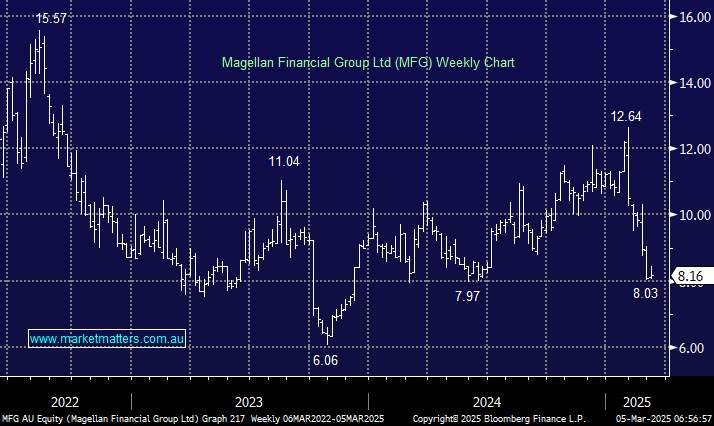

Magellan was added to the Income Portfolio yesterday into weakness near $8, having pulled back from ~$12.40 at the end of January. Several reasons caused the ~35% retracement in such a short amount of time worth highlighting, with the understanding that when we buy weakness, the narrative is going to be poor:

- 30th January 25 MFG announced several changes in their executive and investment teams. At the bottom of page two of the announcement, they outlined the most important change, the resignation of Gerard Stack after 18 years with MFG. Gerard headed up the infrastructure business, which accounts for 43% of MFG’s Funds Under Management (FUM). He was also the Head of Investments more broadly, but it’s his role within infrastructure that mattered. When MFG went through the Hamish Douglas blow-up, their infrastructure business remained solid, and much of the kudos for that was directed to Gerard. His departure was/is significant. The stock dropped on that news for three consecutive days, and rightly so, down to $9.49

- On 20th February, MFG reported 1H25 results and a FUM update where assets under management were steady at $38.6bn. The result was weaker than expected, primarily due to lower average fees being charged across their book, impacting profits. Underlying Net Profit After tax of $84.1m was ~17% below expectations. Their realised fee across the book was 63bps relative to expectations of 70bps. This was a result of FUM mix, which means the composition of lower-margin institutional money versus higher-margin retail money, however, it also implies a higher level of rebates, often given to institutions. On the conference call, they said this was no larger than usual; however, the numbers imply it was. Lower fees for active managers is a trend that will continue.

- They also declared an interim dividend of 26.4c (85% franked) and announced Sophia Rahmani as Chief Executive Officer and Managing Director of MFG, effective 3 March 2025. On results day, the stock closed at $9.08.

- MFG has since traded ex-dividend and been dragged down by broader market weakness, to end yesterday at $8.16, an aggressive 35% pullback from recent highs.

MM has been looking at MFG into weakness on each leg lower; however, we waited until yesterday to pull the trigger. If we back out the value of Magellan’s principle investments, worth ~$2.20, the funds management business trades on around 8x earnings. While the turnaround is taking more time, and Stack’s resignation is a clear negative, we believe the sell-off in the stock has been exaggerated.

We expect a dividend yield of at least 6% fully franked. We also believe the market is underestimating MFG’s recent acquisition of Vinva and strategic stake in Barrenjoey. We see MFG becoming a funds business with multiple brands, each tapping into its established distribution network. We covered the Vinva acquisition in more detail back in October 2024 (here) when we were long the stock before selling out just shy of $12.

- We have turned positive on MFG for Income, as earnings growth will remain a challenge. However, its valuation does not price growth, and (we think) it’s already pricing chunky outflows that may or may not occur.