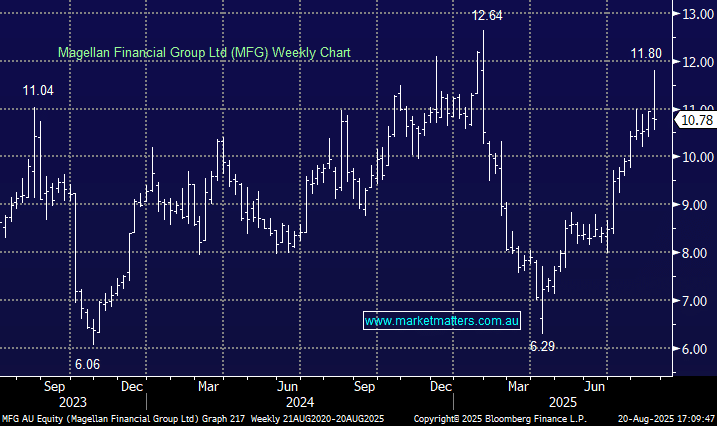

MFG +1.6%: Was up closer to 11% early in the day after delivering a strong FY25 result. This was a solid operating performance and exciting their partnerships are going so well, although some margin pressure was evident.

- FY25 revenue of $318.9mn vs $378.6 milllion y/y but above expectations.

- Investment Management revenue fell 12% due to lower fees.

- NPAT of $165 million -31% y/y but in line with $165.6 million estimate.

- Final dividend of 25.9c and a special dividend of 21c, both fully franked and payable on September 9th.

Strategic partnerships are driving growth. Income from Barrenjoey, Vinva, and FinClear surged, with partnership EBIT up over 200%. The Vinva stake added scale and diversification, while fund investments delivered 15% returns. This stock has worried many investors since COVID-19, but it’s starting to deliver and looks good at $10.50-11.