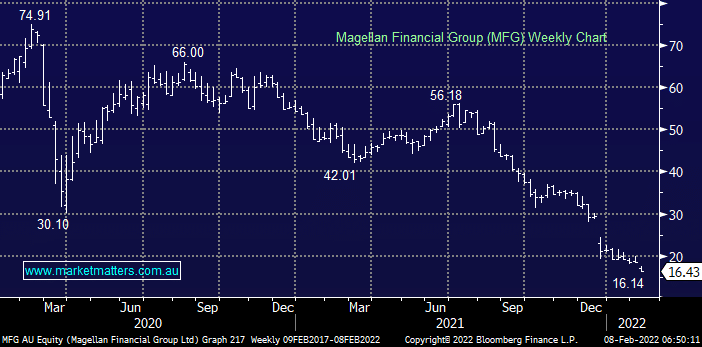

As most subscribers know MFG has been battered over the last 6-months due to the combination of poor performance, FUM withdrawal, disruption at the board level and personal / health uncertainty around CIO Hamish Douglass. Markets hate uncertainty and MFG has unfortunately delivered it in spades but the stock is undoubtedly now very cheap at current levels if the board can steady the ship. The risk / reward towards MFG is clearly improving by the day, as it falls, but further negative news wouldn’t surprise hence at this stage its sitting in our Hitlist – remember invest to sleep and MFG feels like its more likely to keep us awake over the coming weeks.

NB FUM is the acronym for funds under management.

We have a small MFG position in our Active Income Portfolio where in hindsight we caught the falling knife too soon, we have no plans to average at this stage.