- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

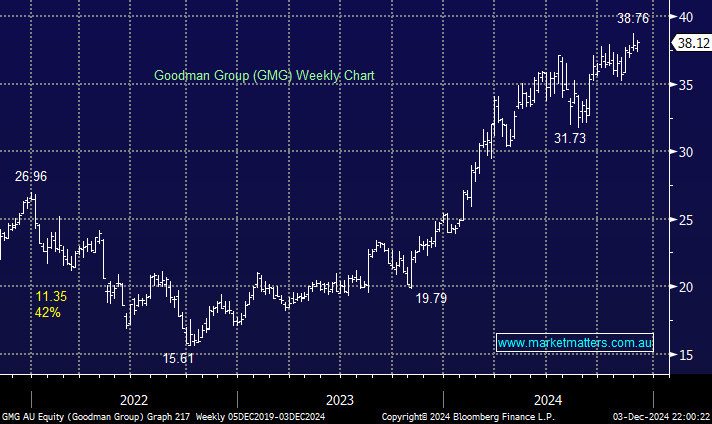

After yesterday’s close, China Investment Corporation (CIC) launched a massive $1.9 billion selldown of market darling Goodman Group (GMG). Citi’s equities desk was looking to place 50.4 million GMG shares or about 2.6% of the company; to put things into perspective, only 3.7 million shares exchanged hands on Tuesday.

- The block trade was structured as a variable-price bookbuild with a floor of $37.55 and 5c increments from there. As at 9.40am, the trade had not yet printed. Citi has underwritten the trade, so it will be done at $37.55 or better.

At yesterday’s close, GMG was up 50% year-to-date, aided by the company’s expansion into the “hot” data centre sector. Before last night’s block trade, Leader Investment Corporation and CIC owned 150 million shares of GMG. CIC has promised not to sell any further shares for 60 days. Data Centres now account for over 40% of work in progress, and this will continue to increase as the company evolves with this new megatrend. We still expect to own this company at some point in 2025, but a large sell-down such as this, plus the psychological overhang of the balance of CIC’s holding, is likely to at least cap the stock in the short term.

- In August, we exited our GMG position at $36.44 on valuation grounds, it appears that CIC agrees with our logic.

- We continue to like GMG as a business, but it remains “rich” in our opinion – GMG is in our Active Growth Portfolios Hitlist.

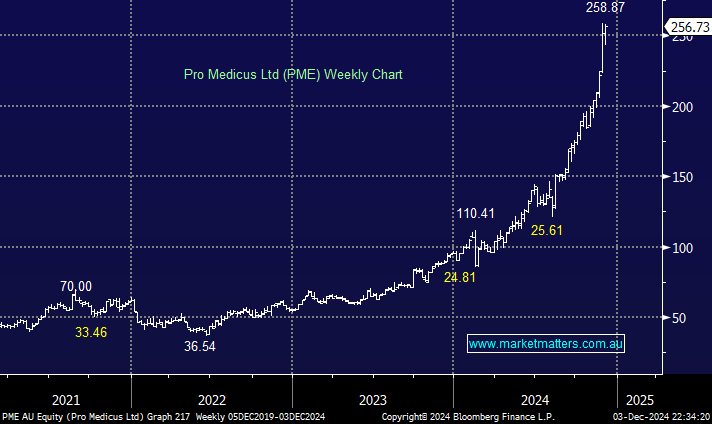

We also saw a big $513 million block of Pro Medicus (PME) shares done in two lines after the close yesterday at $256.73. It’s rumoured that two founders, Sam Hupert and Anthony Hall, were effectively bid for their stock; they both own around $6bn each of the radiology imaging giant. The company continues to kick goals, but with it trading on over `240x Est. for FY’25, it’s easy to comprehend why the founder would lock in a profit on a small portion of their holding. Plenty of growth is expected from this $27bn business, whose net profit rose to $82.8 million on the back of $161.5 million in revenue from the year to June 30, although PME is growing profits and revenue about 30% pa.

- We continue to like PME as a business but feel like we’ve missed the boat. PME is on our Active Growth Portfolios Hitlist.

Further, Zip Co’s co-founder, Larry Diamond, sold $100 million worth of shares in the BNPL company on Tuesday, a day after he resigned to start a family office and philanthropic foundation; we see this as no reason to panic. Diamond is understood to have parted with 30 million shares at $3.35, and yesterday’s close above $3.40 illustrates there’s still plenty of appetite for the stock.

- We continue to like ZIP, but some consolidation between $3 and $3.50 wouldn’t surprise us. MM is long ZIP in our Emerging Companies Portfolio.

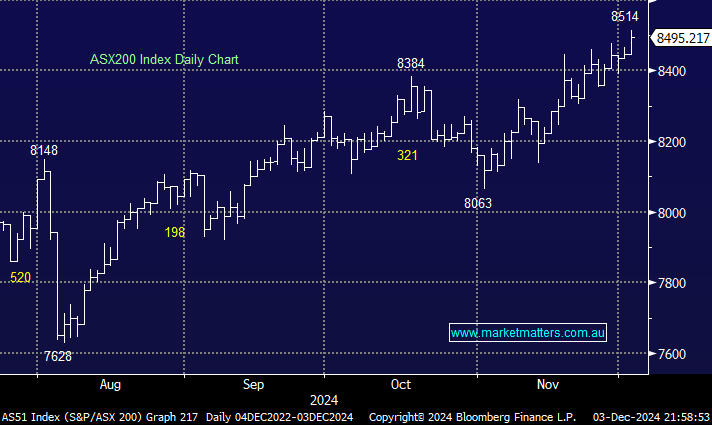

The ASX200 posted fresh highs on Tuesday, nudging above 8500 for the first time before closing a few points shy of the psychological level. Over 60% of the main board closed higher, with the healthcare and consumer discretionary sectors advancing by over 1%. Improved optimism toward another Fed rate cut helped fuel the rally: Fed governor Christopher Waller said, based on the day’s economic data, he was leaning toward supporting a rate cut at the central bank’s meeting in two weeks.

- We have been targeting the 8500-8600 area into Christmas for months, and while that’s now been achieved, we are giving the bullish trend the benefit of the doubt.

Overseas markets were mixed overnight. European bourses advanced, with the EURO STOXX 50 +0.7% and the UK FTSE +0.6% both delivering solid performances. Conversely, the US indices were mixed, with the US S&P500 finishing flat while the NASDAQ gained by +0.3%. One statistic that caught our eye on CNBC this morning was: “When the market is up 10% or more with a newly elected President, it has never gone down in December,” all part of the Christmas spirit!

- This morning, SPI Futures are calling the ASX200 to open down -0.35% with plenty of buying sucked out of the market overnight by the sell downs of GMG and PME – BHP closed up around 1% in the US after a solid 24-hours for iron ore.