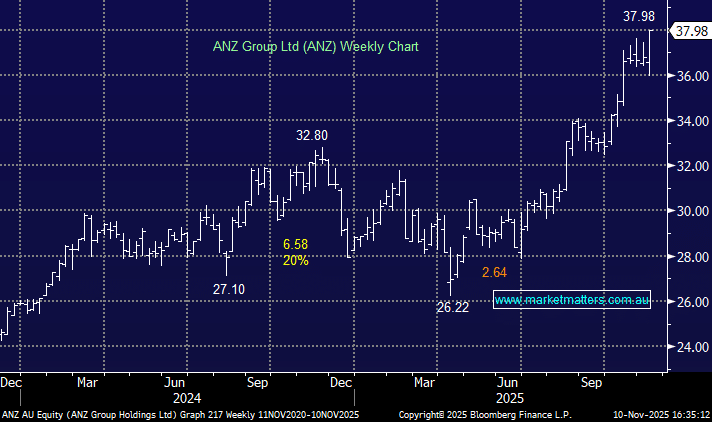

ANZ +3.21%: Despite a weaker-than-expected headline profit in today’s FY25 result, the positive reaction from the market showed the focus remains on the strategic reset laid out by new CEO Nuno Matos in mid-October.

- Cash Profit: $5.79bn (–14% YoY) vs $6.28bn est.

- Final Dividend: 83cps (flat YoY)

- Net Interest Margin: 1.55% (vs 1.57% YoY)

- CET1 Ratio: 12% (vs 12.2% YoY, above 11.7% est.)

- One off Credit Impairment Charge: $441mn

The result reflected margin compression in Australian retail, cost pressures, and softer institutional earnings, partially offset by ongoing strength in New Zealand. ANZ noted that overall credit quality remains sound, with only a modest lift in provisions and low levels of stress across the book.

The focus now shifts squarely to the freshly announced roadmap — targeting a ROTE of 12% by FY28 and 13% by FY30, and a cost-to-income ratio in the mid-40s through structural simplification, digital transformation, and cultural change.

The stock’s intra day rebound suggests confidence from the market that ANZ has drawn a line under its patchy execution of recent years. With the prospect of improving growth from FY26 onward, we think the market’s optimism is warranted — though execution will be key.