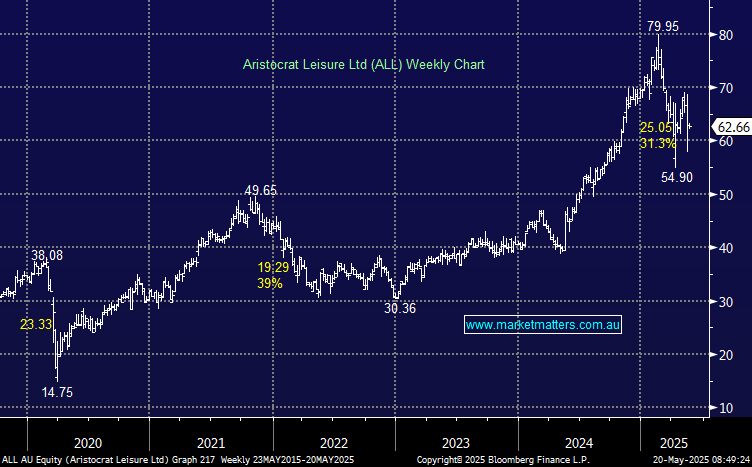

We are selling Aristocrat (ALL) for a small loss today following their weaker 1H result last week. We bought the stock a month ago (~$65) and while this is a short hold for MM, we see better opportunities to deploy the capital elsewhere, expecting the stock to tread water at best.

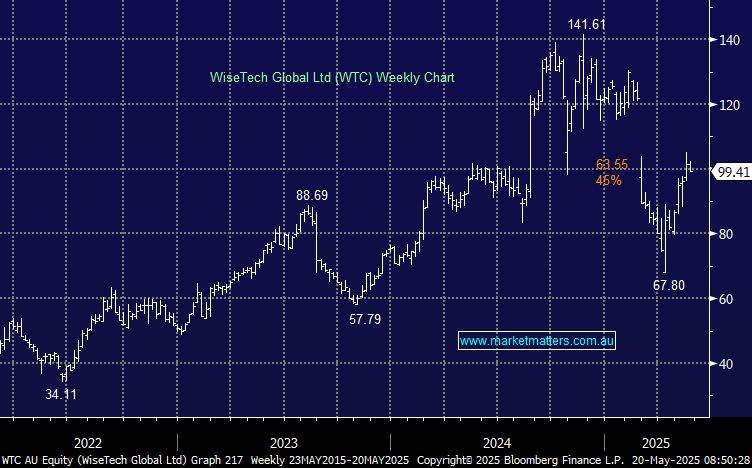

We are buying Wisetech (WTC), bullish on it’s medium term growth prospects in the highly fragmented logistics sector. There is little doubt that Richard White has driven the success of WTC and his ongoing involvement is a positive (putting personal issues to one side).

Iluka (ILU) has been a disappointing position with the mineral sands and rare earths company weighted down by persistently weak demand. We retain significant resources exposure, leveraged to a rebound in China, but believe the funds from ILU are better placed elsewhere.

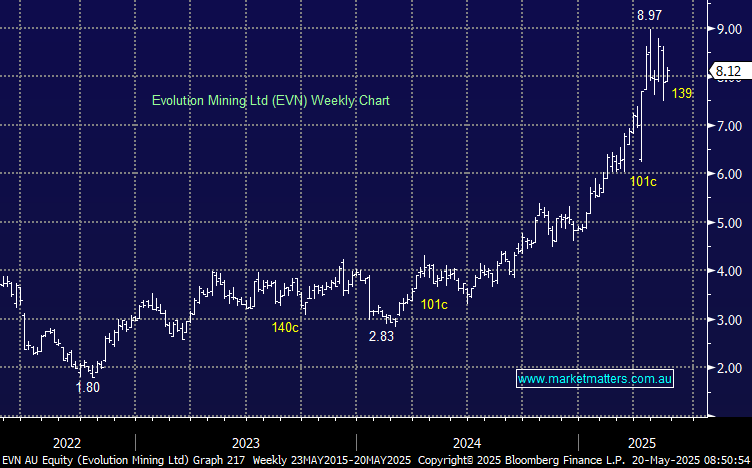

We are buying back into Evolution Mining (EVN), holding the view that the recent correction in Gold prices is likely complete. We sold EVN in March at $7.10, having bought the position below $3. We are now paying a higher price to re-enter the stock, however, that happens at times and we must remain open minded across our portfolios.