Life360 (360) has pulled back aggressively from its highs, now trading on a more palatable valuation. We think the risk/reward is solid around ~$42 considering the medium and long term growth outlook for the business.

Light & Wonder (LNW) looks attractive now that it has fully redomiciled its listing to the ASX, with passive buying likely to be a tailwind, in addition to an extended buyback and a strong result at its recent quarterly update.

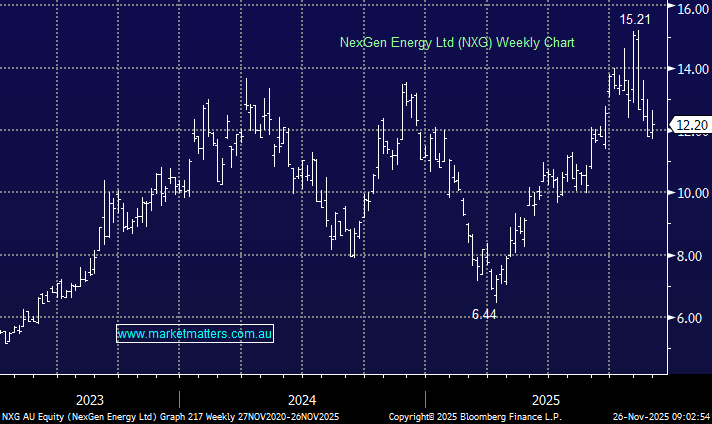

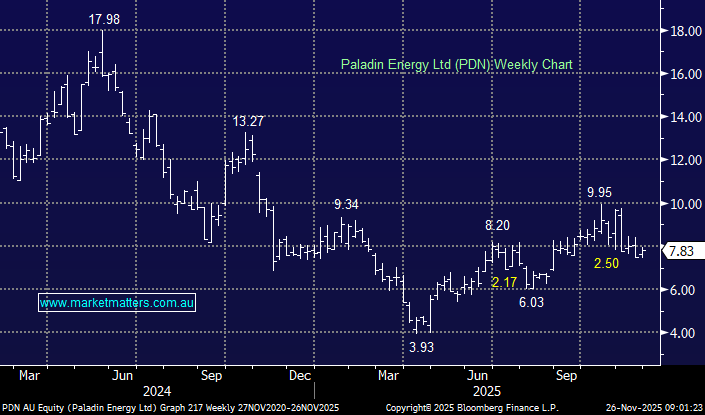

We are switching our existing uranium exposure (in the Emerging Companies Portfolio Only) from Paladin Energy (PDN) to NexGen Energy (NXG) given the latter is still in exploration and development stage, for greater leverage to growing global uranium demand.

We remain bullish on Paladin as a later stage uranium producer, and will still hold it in the Active Growth Portfolio, however we are selling this position and switching to development stage NexGen Energy (NXG) for greater leverage, in line with the higher growth characteristics of the Emerging Companies Portfolio.

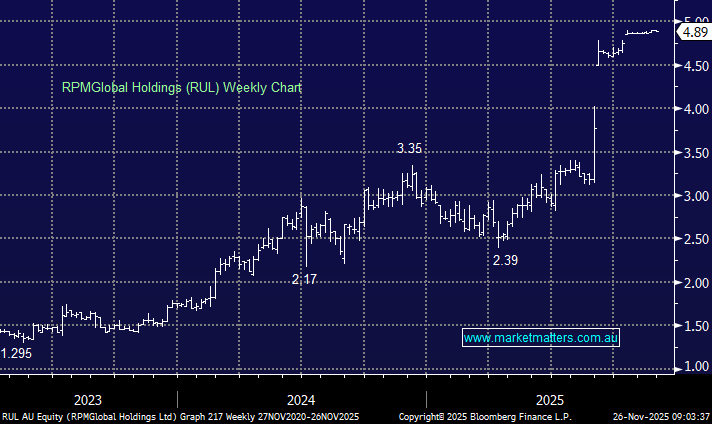

The takeover of RPMGlobal (RUL) by Caterpillar (CAT US) is expected to complete in the first calendar quarter of 2026 – the deal is all but done so we will lock in a 60% profit, to better utilise the funds elsewhere.