ANZ’s new CEO Nuno Matos drew a line in the sand at their strategy day today and delivered what we were expecting/hoping, with a clear blueprint to improve the bank’s returns after multiple years of underperformance – all about discipline, cost control and culture.

Key points;

- Buyback on Ice: ANZ will pause the remainder of its $800 million share buyback, signaling a shift in priorities as CEO Matos targets a 12% return on tangible equity by 2028.

- Back to Basics: he made it clear he plans to “put the house in order” — cutting duplication, tightening costs and leaning heavily on AI and automation to drive efficiency.

- Cultural Reset: After years of reputational hits and regulatory headaches, Matos wants to reset the bank’s culture and fix the “basics.” Recall that earlier this year, APRA slapped ANZ with an extra $250 million capital buffer after governance failures were uncovered.

- Sharper Focus on Clients: The bank will hire more branch-based mortgage lenders and business bankers, even as broader job cuts continue. Matos told investors ANZ is “spending less, but better.”

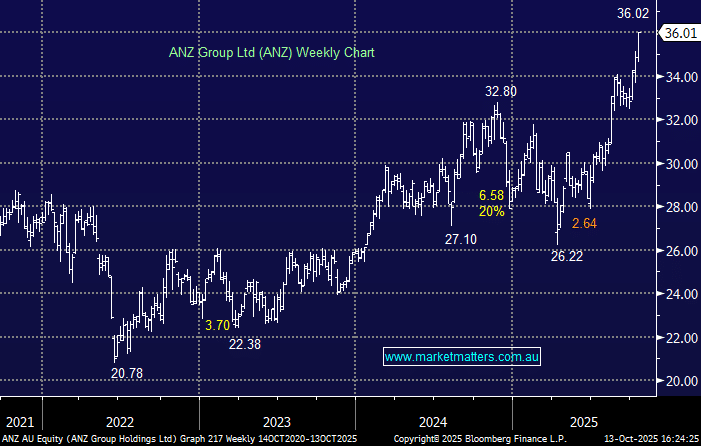

The market reaction was positive, with ANZ trading above $36 for the first time since 2015, materially outperforming the other majors – CBA -1.87%, NAB -1.84% & WBC -0.94%.

- We continue to believe ANZ offers the best upside amongst the majors.