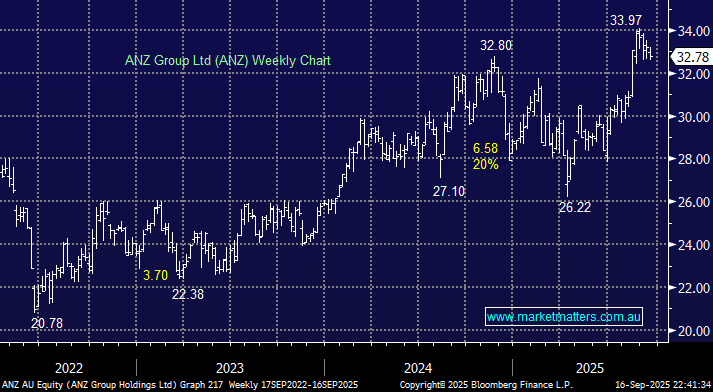

ANZ grabbed several headlines this week for the wrong reasons while they also hosted an investor call to provide more clarity on how they are addressing these challenges, and importantly, what the immediate focus is for the bank. New CEO Nuno Matos has a lot on his plate, though he is moving at pace, making the tough calls others have failed to make in recent years. That said, there’s no escaping the reality that transformation in retail banking will take time. We’ll get more details at a strategy day on October 13. For now, this is the state of play:

- ANZ trades at a material discount to the other majors, on a Forward PE of 14.3x and 1.4x book, which is a 20-25% discount to big 4 peers depending on the metric used, implying a lot of this negative news is already priced in.

- On Monday, they confirmed they will pay a record $240m penalty to ASIC for misconduct across its markets and retail businesses – the largest ever ASIC fine. This brings a long-running saga to a head.

- That is on top of an enforceable undertaking with APRA, a $250m operational risk capital overlay, and ~$150m of remediation spend flagged for FY26, all of which was already known.

Last week, they also announced ~3,500 job cuts (~8% of headcount) and a $560m restructuring charge. The changes are concentrated in retail banking and technology, areas where ANZ clearly needs a reset. Over the next 12 months or so, the challenge will be balancing reform and returns. As investors, we want clarity on dividends, capital buffers, and whether the bank will increase credit provisioning to bring it more in alignment with peers, which would likely contribute to a small cut to the dividend, something the market is now starting to price in, after UBS flagged the prospect a few months ago– the question is how deep and what payout ratio follows.

While ANZ is ‘cheap’ relative to the sector, its forward PE of 14.3x sits more than two standard deviations above historical averages, suggesting value isn’t as clear-cut in an absolute sense. The strategy day in October will be critical for Mr Matos to garner market support for his slated plans – execution is now everything after a period of back-to-back failures.

- While we think ANZ is cheap for a reason right now, with the right execution, the gap to peers can easily narrow.