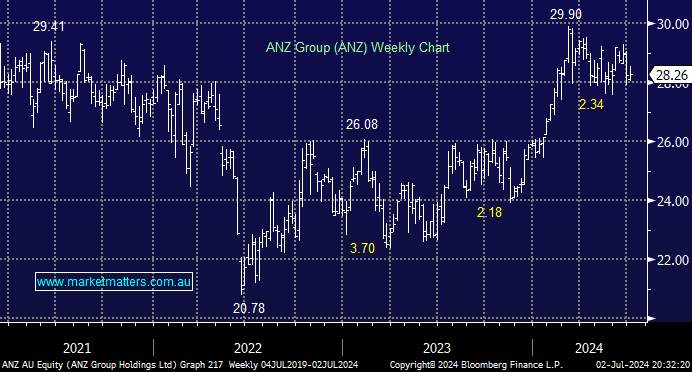

The deal is marginally positive for ANZ as it affords the bank further scale, geographic expansion, and product diversification in its business. While there are a few small changes around the conditions for the acquisition, they will have no material impact for either party. The acquisition of Suncorp Bank adds ~$70B in loans to ANZ’s balance sheet and addresses their underweight exposure to the country’s 3rd largest retail banking market, Queensland. ANZ will remain the 4th largest bank in Australia, but the deal will see ANZ move past NAB to become the 3rd largest player in both Owner Occupied Mortgages and Household Deposits.

The market understands this deal, which was initially announced back in July 2022, but there is the potential for slightly faster synergies than many expect. Although most analysts have an entrenched anti-bank mindset, we continue to like ANZ. With a part-franked yield of ~6% (moving towards being fully franked), we see no reason to sell our position even if the stock is trading slightly above its average historical valuation. Much of the market trades at far loftier valuations as we knock on the door of all-time highs. We believe the market has the banks wrong unless the RBA gets too aggressive and pushes the local economy into a painful recession.

- We are initially targeting a move by ANZ back above $30 – MM is long ANZ in our Active Growth Portfolio.